About Bitwala

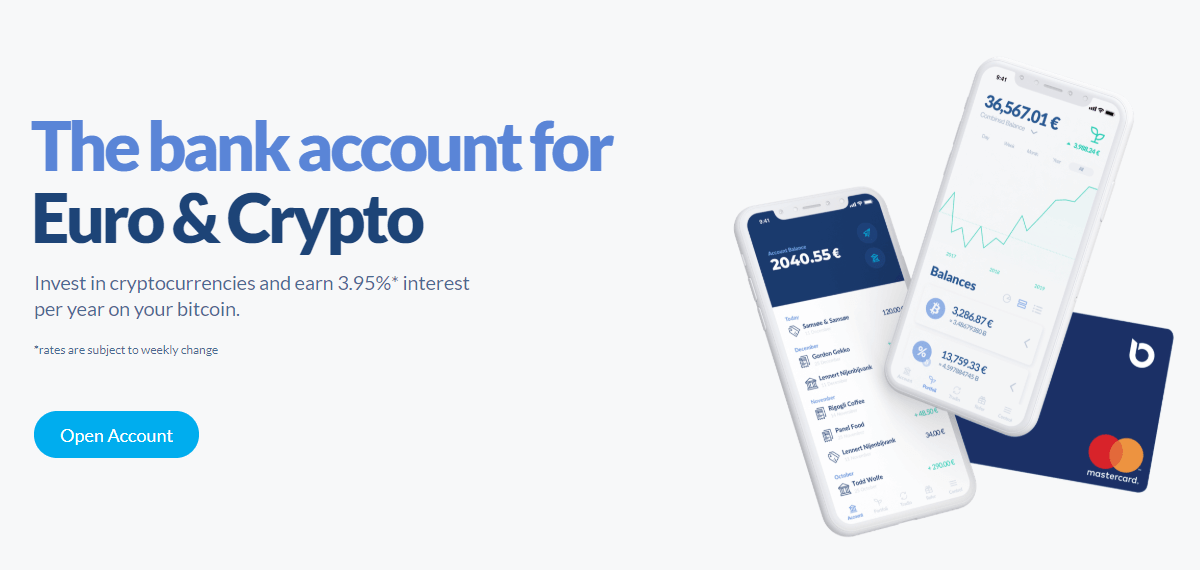

Bitwala is difficult to compare with any other provider or service in the crypto industry. The Berlin company is not a “usual” cryptocurrency exchange, but offers on its platform the world’s first account that combines a regular bank account, a Bitcoin and Ethereum wallet and a trading service on a single platform. Recently, Bitwala has even started offering its customers the opportunity to earn interest on their Bitcoin accounts at a rate of 3.95% annually.

The company behind Bitwala was already founded in 2013 and launched in early 2015 with a prepaid card for payments in cryptocurrencies. After Wavecrest, the company that provided Bitwala and many other crypto companies with prepaid cards, lost its license in 2018, the company had to temporarily suspend its services.

However, Bitwala celebrated its comeback in the same year with an additional 4 million euros in capital from well-known investors such as EarlyBird and coparion. In July 2019, Bitwala again received 13 million euros in a Series A financing round, which not only greatly increased the company’s financial resources, but also further enhanced its confidence in the company. Currently, following the partnership with the German solarisBank, the company offers the first bank account for crypto and Fiat currencies (Euro).

The most important information about Bitwala at a glance

- All-in-one bank account for Fiat and cryptocurrencies

- German bank account with SolarisBank, including debit card

- Self-determined Bitcoin and Ethereum wallets

- Euro deposit protection up to 100.000 €

- Mobile Trading App to buy and trade Bitcoin and Ether

- Bitcoin income account with up to 3.95% annual interest

- Report for tax on all crypto purchases and sales

- Only for residents in the European Union

The services of Bitwala

Bank account with all functions

The Bitwala* bank account combines Fiat and cryptocurrencies in the same bank account. This allows you to carry out everyday transactions from your bank account both on the move and from your desktop, such as issuing standing orders and transfers. For example, you could sell 3 BTCs, which are then converted into the equivalent value in EUR and can be used to pay for a trip via SEPA bank transfer.

In addition, Bitwala offers the unique ability to buy and sell Bitcoin directly from a single account. When you buy Bitcoin, you pay with the Euro balance from your checking account. Bitwala will then send you the corresponding Bitcoin amount to your Bitcoin wallet. When you sell, the Bitcoin amount is transferred away from your own wallet and the corresponding Euro amount is credited to your current account.

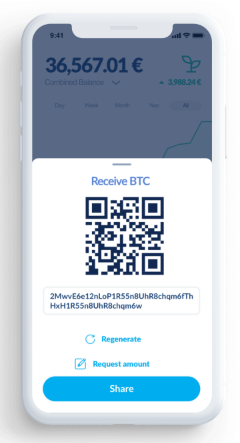

The Bitwala crypto wallet

Bitcoin and Ethereum can be stored via Bitwala’s own wallet*. The two wallets function like “normal” wallets and allow BTC and ETH to send, transmit and store. In addition, wallet users have the option to exchange Fiat for crypto or vice versa.

It is important to know that the Bitwala wallet gives users full control over their private keys and their backup phrase, as both wallets are non-custodial. So this is a major difference to “classic” crypto exchanges like Binance or Coinbase, because the coins are much more secure.

The Bitcoin wallet is a multi-signature wallet that can be accessed via web browser or smartphone via iOS or Android app. The wallet is secured by a backup copy consisting of a master and backup key. The Ethereum wallet is currently only available via the Bitwala app and is secured with a 12-word phrase.

The debit card from Bitwala

Another heart of Bitwala is the debit card from Mastercard*, which is part of your German bank account (in Euro). The debit card works like a “normal” debit card and can be used anywhere in the world where Mastercard is accepted. Furthermore, the debit card supports free cash withdrawals at all ATMs worldwide (as long as Mastercard does not charge fees itself) and offers the function of contactless payment. When you sell Bitcoin (BTC), your balance will be credited to your bank account in euros in less than an hour.

It is also protected by the 3D Secure process. The code gives you an extra layer of security, so you are safe when you shop online. For people who like to travel, the card is interesting because you can use it anywhere in the world for free. With the Mastercard currency converter you can always find out the daily exchange rates for ATM withdrawals. On your account statement the estimated exchange rate is also displayed for each foreign currency transaction.

It is important to know that the Bitwala debit card has a number of standardized daily and monthly spending limits.

Monthly limits:

- Online payments: 10.000 €

- Offline payments: 10.000 €

- Withdrawal from cash dispenser: € 10,000

Daily limits:

- Online payments: 1.500 €, can be increased up to 5.000 €

- Offline payments: 1,500 €, can be increased up to 3,000 €

- Withdrawal from cash dispenser: €3,000

The arnings account for Bitcoin

For long-term investors, the option of an earning account* is also very interesting. This allows you to invest your Bitcoins, which are only on a wallet anyway, for a passive income. The income is paid directly to your income account in Bitcoin every Monday. Bitwala works together with Celsius to implement the account.

Bitwala indicates a yield rate of up to 3.95%, whereby the interest rate is dynamically adjusted according to supply and demand. If the demand for credit is high, Celsius can pay a higher rate of return for the cryptocurrency in demand. If demand is low, Celsius pays a lower rate of return.

Crypto tax made easy

Another useful function Bitwala offers is tax reporting. Through a cooperation with CryptoTax, all purchases and sales are recorded in such a way that with just a few clicks, you can obtain a customized, ready-made record for the tax authorities of your trades and transactions at Bitwala.

Fees

Another clear advantage of Bitwala is its transparency, which is particularly evident in the fees charged for using the various services. These are easy to find on the Bitwala website and are as follows:

- Account management fees: 0,00 EUR

- Fees for providing a debit card: 0.00 EUR

- Repeat order of a debit card: 9,50 EUR

- Fees at cash dispensers: 0.00 EUR (or depending on the provider of the dispenser)

- Card transactions: 0.00 EUR (Mastercard may charge fees for international transactions)

- Trading fees for Bitcoin and Ethereum: 1% (minimum amount: EUR 30)

Opening an account with Bitwala

Basically the process of opening an account with Bitwala is very simple and straightforward. However, you should be aware that you can (logically) only use the platform if you open a new bank account with Bitwala. As this is a German bank account, it is only available in Euro (not USD). Furthermore, all customers must meet the following criteria to open a Bitwala account:

- Resident in the European Union

- A valid passport/ID card. A list of supported documents can be found here

- Over 18 years old

- A document for proof of address

If you meet the criteria, the registration will be done in two steps. First you open the bank account. The second step is to verify your identity by means of a video call. During the video call with Bitwala’s partner, IDnow, employees are asked for proof of address. The whole registration process is very simple and intuitive.

Bitwala in test

Security and reliability

Regarding the seriousness of Bitwala, there is no doubt in our opinion that the platform is 100% trustworthy. For the bank account Bitwala works together with the renowned German SolarisBank. In addition, Bitwala GmbH is a company registered in Germany that has received several rounds of funding and has been co-financed by the European Union’s Horizon 2020 programme.

With regard to security, Bitwala has implemented the security mechanisms customary in the industry. In accordance with legal requirements, Bitwala also offers a Euro deposit guarantee of up to 100,000 Euro.

The customer support

Bitwala offers an extensive support site for its users. The Bitwala website offers a comprehensive support center where the most important information is summarized in a compact and clear manner. If this is not enough, the Bitwala support team can be contacted via social media (Facebook, Twitter, Reddit and Bitcoin Talk).

Customer reviews

On Trustpilot Bitwala receives 3.8 of 5 stars (at the time of writing). The latest ratings are mostly very positive (5 stars). In general, customer support and the platform are rated very good throughout. The customers are mostly satisfied with Bitwala. Numerous reviews emphasize the fact that the platform runs faultlessly, is uncomplicated and enables fast transactions.

Complaints come from users who want to take action. They say that the trading fee is higher compared to other platforms. Bitwala justifies this with the availability of other practical features (wallet, debit card, bank account). Another frequently mentioned criticism is the video call for verification, which is done by an external partner and does not always work smoothly.

Conclusion on Bitwala

Bitwala is a great option for European customers who do not see their Bitcoin as an investment only, but also want to use it to pay for purchases and bills. By combining a bank account and crypto wallet, Bitcoin and Ethereum owners can convert their funds into euros and pay bills within an hour.

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.

Bitwala’s debit card also offers the advantage over other providers of cash cards that it can be used worldwide free of charge. From our point of view, we can therefore recommend Bitwala to every crypto enthusiast!