In this article, we will introduce the CFD broker Capixal and examine whether it is a trustworthy and safe option.

About Capixal

Before you deposit money with a broker to use it for trading, you should check in advance who is behind the platform. In the case of Capixal.com, this is IFC Investments Cyprus Ltd, a limited liability company incorporated in the Republic of Cyprus with registration number HE342390, licensed by the Cyprus Securities and Exchange Commission (CySEC) under license number 327/16 and whose registered address is: Arch. Makariou III, 242nd P.Lordos center, block A, 2nd floor, Office 203, Limassol.

Now, what does the platform offer? Traders have the opportunity to trade over 350 CFD assets on the platform, which is incredible and should satisfy the demand of most market participants. As a user, you can choose from all markets: Stock trading, CFD trading, Indices, Forex, Commodities, just to name a few. In the cryptocurrency space, you can access the most popular ones such as Bitcoin, Ripple, Ethereum, Litecoin, Bitcoin Cash, etc. as CFDs.

In commodities trading, you can access more than 25 commodity assets as CFDs – from gold, silver, platinum to natural gas, oil, cocoa, corn and sugar. In the stocks section, you can buy and trade CFDs of renowned companies such as Apple, Google, Tesla, Microsoft, Netflix, Disney, Amazon, Intel and several others.

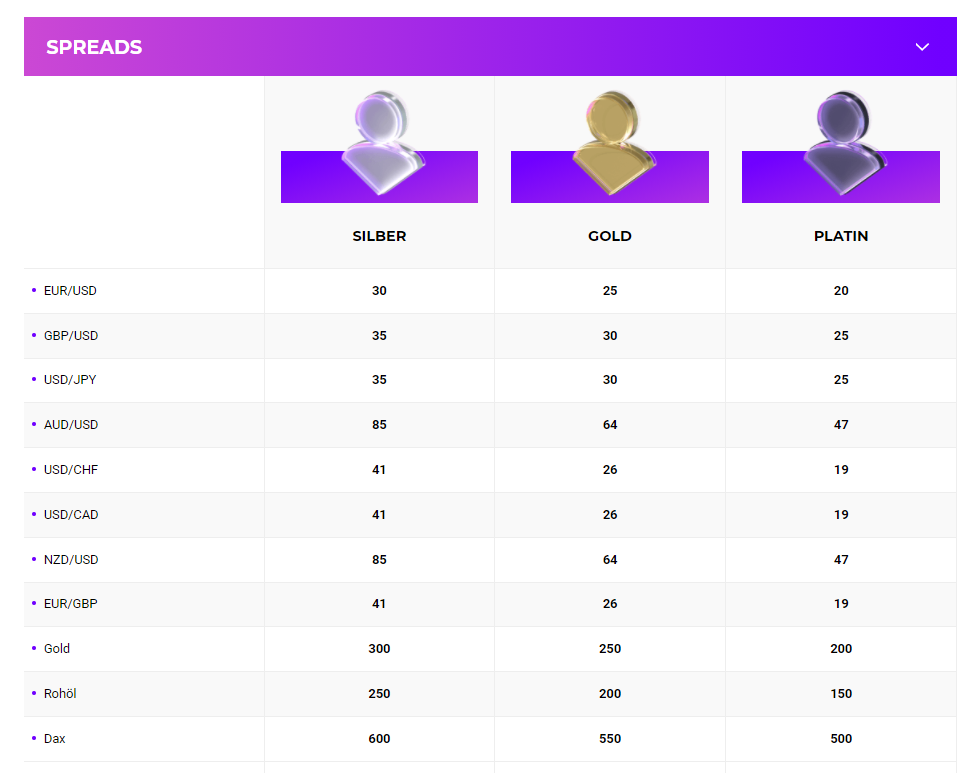

You can choose between three account types: Silver, Gold and Platinum. In addition, there is an Islamic account. Generally, trading on Capixal is done through the renowned MetaTrader 4 trading software, WebTrader or a mobile app, so you have every possible way to access your portfolio. The maximum leverage depends on the account type and asset class, but it is maximum:

- Forex: 1:500

- Indices: 1: 500

- Commodities: 1:150

- Commodities: 1:125

- Equities: 1:10

- Cryptocurrencies: 1:2

Most important info at a glance

✅ Website address: https://www.Capixal.com

✅ CFDs: currency pairs, cryptocurrencies, commodities, stocks, indices and commodities

✅ Leverage: up to 1:30 (for retail traders), up to 1:500 for professional traders

✅ Minimum deposit: from $250

✅ Deposit and withdrawal methods: credit card, Neteller, Skrill, Webmoney, bank transfer

**Risk Warning: CFDs are complex instruments and carry a high risk of losing money quickly due to leverage. The vast majority of retail investor accounts lose money trading CFDs. Think carefully about whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Is Capixal trustworthy?

When it comes to the question of trustworthiness, traders should ask themselves two questions:

- Is the broker regulated?

- Does the broker take industry standard measures to ensure customer safety?

Regarding the first question, it can be stated about Capixal, as mentioned at the beginning, that Capixal is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 327/16. The authority ensures supervision, maintenance of sufficient capital and regular audits. Due to its location in the European Union, Capixal is thus also subject to the strict regulatory requirements of the EU.

In terms of security, it has to be noted that the broker provides industry standard security for client funds by adhering to the following regulatory requirements: Keeping client funds in separate accounts from company funds, and providing a negative balance protection policy. In addition, the website can boast secure SSL encryption to protect all data during transmission.

Another plus point is that the platform provides a good selection of research and educational materials. For instance, clients can access research via the Signal Centre, which contains trading signals for forex and index markets. There are also e-books, courses and tutorials to help traders maximize their success. Last but not least, Capixal offers multilingual customer support that is available 9 hours a day, Monday through Friday via email, phone and live chat.

Account types at Capixal

When choosing an account type, Capixal offers you three options. All accounts, meanwhile, have in common that there are no deposit limits, no deposit and withdrawal fees, and over 350 different assets. In addition, private clients always have a maximum leverage of 1:30, while professional clients can have a maximum leverage of 1:500.

However, depending on the account type, there are differences in spreads, as the following screenshot of the website (as of 04/2021) shows.

There are also differences in the services and extras that the platform offers. Below we have compiled the most important information:

Silver account

- Safeguarding of funds

- Fifth decimal place

- no financing fee discount

Gold account

- Safeguarding of funds

- Fifth decimal place

- 25% discount on financing fees

- Personal account manager

Platinum account

- Protection of funds

- Fifth decimal place

- 50% discount on financing fee discount

- Personal account manager

- Free VPS

- Individualized investment news

Platforms for trading on Capixal

Meta Trader 4

Like numerous other trading platforms, Capixal makes use of the renowned and long-established Meta Trader 4, commonly known as MT4 and considered one of the most advanced and widely used trading platforms within the financial industry worldwide. When using it, users can benefit from advanced analysis tools, a wide range of charts and ultimately one of the most proven trading tools on the market.

WebTrader

In addition to MT4, Capixal also offers its clients the opportunity to trade via a WebTrader platform based on MT4. Through this, users also get access to 350+ markets, 60+ analytical tools, real-time price streaming, customizable price alerts and “one-click trading”.

Mobile App for Android and iOS

The third option is to access mobile trading on the go via the MetaTrader 4 Mobile Trading App for Android and iOS systems. The app is available on Google PlayStore and Apple AppStore respectively and allows trading and managing the user account on the go. Among other features, the app includes 3 chart types, 9 time frames, as well as charting and live trading.

Available CFDs on cryptocurrencies

On Capixal, you can choose from 20 different cryptocurrencies as CFDs, as well as more than 30 different trading pairs. Below is the list of available crypto CFDs (as of 04/2021):

- Cardano Vs. US Dollar (Bittrex)

- Bitcoin Cash ABC Vs. US Dollar (Bitfinex)

- Bitcoin Vs. Chinese Yuan, Euro, Great British Pound, US Dollar

- Bitcoin Gold vs. US Dollar (Bitfinex)

- Dogecoin vs. US Dollar (Bitfinex)

- Dash vs. Euro, US Dollar (Bitfinex)

- EOS vs. US Dollar (Bitfinex)

- Ethereum Classic vs. Euro, US Dollar (Bitfinex)

- Ethereum Vs. Euro, Great British Pound, US Dollar

- IOTA Vs. US Dollar (Bitfinex)

- Chainlink vs. US Dollar

- Litecoin Vs. Euro, US Dollar

- NEO Vs. US Dollar (Bitfinex)

- Tron Vs. US Dollar (Bitfinex)

- Stellar Vs. US Dollar (Bitfinex)

- Monero Vs. US Dollar (Bitfinex)

- Ripple Vs. Euro, US Dollar (Bitfinex)

- Tezos Vs. US Dollar (Bitfinex)

- Yuan Chain Coin (YCC)

- Zcash vs. US Dollar (Bitfinex)

Trade crypto CFDs on Capixal

Fees

Capixal does not charge any deposit or withdrawal fees. However, the following fees apply:

- Spreads: the difference between the buying price (rate) and the selling price (rate) of the financial instrument. Spreads are variable and are calculated automatically once the position is opened. According to the website, “under normal trading conditions” the minimum spread is applied, while the spread can be widened under extreme trading conditions.

- Rollover Fee: is a daily overnight funding fee charged on all open positions that remain open at 21:00 UTC time each day. An exception rule is Wednesday: the fee for positions held from Wednesday to Thursday is different from other days and includes the fee over the weekend. The overnight swap triples in this case.

- Conversion fees: All cash, realized gains and losses, adjustments, fees and charges denominated in a currency other than your account’s base currency will be converted to the account’s base currency, so the account will be charged a conversion fee.

- Inactivity Fee: For accounts with no trading activity, a management/maintenance fee will be charged on a monthly basis to keep such account available.

Trading accounts with no trading activity for a continuous period of 60 days are classified as an inactive account. Inactive means that you do not open or close a trade or make a deposit. Inactive accounts will be charged with an inactivity fee as follows:

- For more than 61 days of inactivity, an inactivity fee of 160 EUR

- Over 91 days up to a maximum of 180 days, an inactivity fee of 120 EUR will be charged

- Over 181 days up to a maximum of 270 days an inactivity fee of 200 EUR will be charged

- Over 271 days the inactivity fee will be 500 EUR

- or the equivalent amount in the customer’s currency according to the exchange rate of the day.

Registering an account

To open a trading account with the broker, you need to follow the steps below. The process is designed to be simple and intuitive:

- Register on Capixal.com by providing your name, last name, country, phone number and email address for verification.

- Upload the required proofs, including a proof of identity and proof of address.

- Choose your desired asset to trade and deposit the appropriate amount. Start trading!

Payment methods

The process of depositing and withdrawing funds is simple and straightforward. Capixal offers a variety of fee-free deposit and withdrawal methods, including debit/credit card, bank transfers and e-wallets such as Neteller, Skrill and Webmoney. According to the broker’s regulations, deposits are usually processed in a period not exceeding 7 days and withdrawals within 1 business day.

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.

Conclusion

Our review has shown that Capixal is a regulated broker that puts a lot of emphasis on the education of its clients. The review shows how important it is to choose a reputable broker. Capixal meets this criterion by being licensed in Cyprus. On the other hand, the broker offers over 350 CFDs. Private clients can use a maximum leverage of 1:30 for their own protection (due to legal requirements), while for professional clients the maximum is 1:500.

**Risk Warning: CFDs are complex instruments and carry a high risk of losing money quickly due to leverage. The vast majority of retail investor accounts lose money when trading CFDs. Think carefully about whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.