In this article, we will examine CFD broker TradedWell and take a closer look at whether the broker is a trustworthy and safer option.

About TradedWell

TradedWell is the name of the trading platform, which is operated by iTrade Global CY Ltd. This is an investment company that owns the “iTrade” brand and operates TradedWell.com. The company is incorporated in Cyprus and is regulated by the Cyprus Securities and Exchange Commission (“CySEC”). The Company’s registration number is HE 335424 and its CIF license number is 298/16. The registered office of the Company is located at Isiodou, Andrea Laskaratou & Emanouel Roides Street 10-12, 2nd Floor, Ayia Zoni, 3031 Limassol, Cyprus. The Company has also appointed a tied agent, Alef&Kiai S.L., a company incorporated and domiciled in Spain.

Users can choose from 3 account types at TradedWell: Silver, Gold and Platinum, with the highest account type unlocking the most features and benefits. However, regardless of the account type, all users can trade more than 300 CFD financial instruments. The portfolio includes more 30 cryptocurrency trading pairs (as CFDs) as well as currencies, commodities, stocks, indices and metals.

Most important info

✅ Website address: https://www.TradedWell.com

✅ CFDs: currency pairs, cryptocurrencies, commodities, stocks, indices and metals

✅ Leverage: up to 1:30 (for individual traders), up to 1:500 for professional traders

✅ Minimum deposit: from $250

✅ Demo account: Yes, for 360 days+

✅ Deposit and withdrawal methods: credit cards (Visa, Mastercard, Maestro, V Pay), wire transfer, Neteller and Skrill

**Risk Warning: Risk Warning: FX/CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82.78% of retail investor accounts lose money when trading CFDs with this Provider. You should consider whether you understand how FX/CFDs work and whether you can afford to take the high risk of losing your money.

Is TradedWell trustworthy?

The most important question when choosing a broker is whether it is safe and trustworthy. The most important criterion in terms of trustworthiness is regulation by a supervisory authority. In the case of TradedWell, the company behind the platform can boast a license from the Cyprus Securities and Exchange Commission, which is the financial regulator of the European country of Cyprus. The authority ensures supervision, maintenance of sufficient capital, regular audits and security of customer deposits.

In addition, CySEC ensures that client funds are kept separate from the company’s business accounts. Furthermore, TradedWell offers protection against a negative balance. The moment your account balance reaches zero, the broker automatically closes the position so you can’t slip into the negative. Another advantage of the CySEC regulation is that there is a compensation fund in case the platform has to close unexpectedly.

In terms of website security, TradedWell can boast Secure Socket Layer (SSL) encryption, SAS 70 data servers, and a firewall.

To protect users from making bad decisions, TradedWell also offers an extensive educational portal. This includes educational material such as videos on demand (VoD), ebooks, courses, tutorials and daily news. For more advanced users, TradedWell offers numerous tools to evaluate and analyze their own trades in order to make the best decisions for themselves.

Last but not least, in case of any problems, TradedWell also offers customer support that can be contacted via phone call, email and live chat from Monday to Friday 07:00 – 16:00 GMT. All of the above arguments suggest that TradedWell is a reputable CFD broker.

Account types at TradedWell

At TradedWell you can choose between three types of accounts. All accounts have in common that there are no deposit limits, no deposit fees and offer over 300 different CFDs.

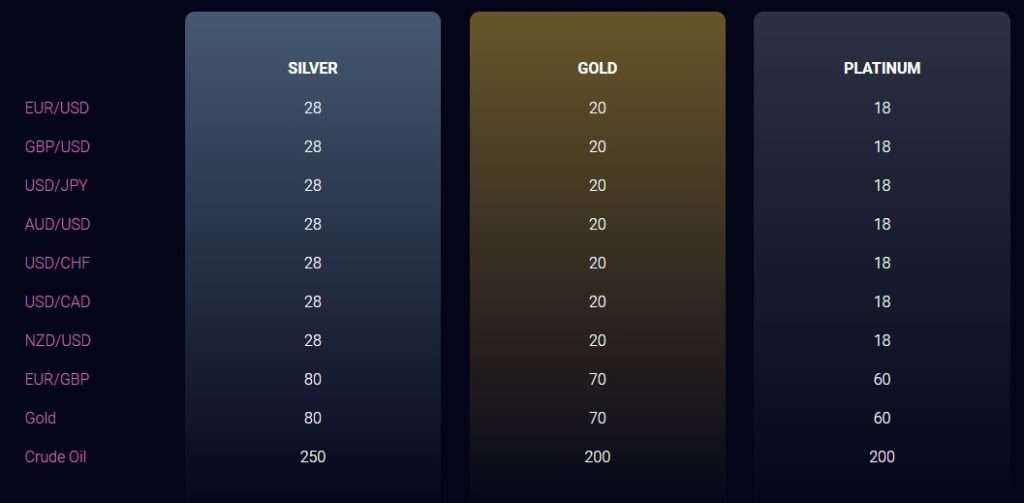

The maximum leverage offered for professional traders is 1:500. Moreover, the leverage also depends on the type of account. For example, for the gold account it is 1:400, for the silver account it is 1:200 and for the private accounts it is 1:30. There are also significant differences in the spreads, which decrease significantly if you choose the gold or platinum account:

Silver account

- Hedging

- FX leverage for retail accounts 1:30

- FX leverage for professional accounts 1:200

- Dedicated account manager

- Personalized investment messages

Gold account

- Hedging

- FX leverage for retail accounts 1:30

- FX leverage for professional accounts 1:400

- Dedicated account manager

- Personalized investment messaging

- Free VPS

- Five decimal points

- Swap discount 25%

Platinum account

- Hedging

- FX leverage for retail accounts 1:30

- FX leverage for professional accounts 1:400

- Dedicated account manager

- Personalized investment messaging

- Free VPS

- Five decimal points

- Swap discount 50%

Platforms for trading on TradedWell

WebTrader

TradedWell WebTrader works in such a way that you do not need to download any software, but can trade directly from your computer. Within the WebTrader you can analyze the latest market news and trading conditions with a wide range of analytical tools. In addition, WebTrader offers you a full history of your trades, a real-time balance level, automatic stop loss/take profit functions, multi-lingual support, 1-click account switching and inherent platform support, as well as live chat.

Mobile App

If you like to trade on the go, there is an app for Android and iOS, which you can download from the respective app store. By means of the app, you can get full control over your trading from any place and at any time. The mobile app has the same functionality as the WebTrader, so you can check your account balance in real time, use stop loss/take profit functions, contact multi-lingual support and use over 60 professional analysis tools.

Available CFDs on cryptocurrencies

On TradedWell, you have 24 different trading pairs available for CFDs on cryptocurrencies. The big advantage of CFDs over “real” cryptocurrencies is that you do not bear the risk of custody. Thus, you don’t have to worry about storing them in a wallet. Below you can find the list of available trading pairs

- Bitcoin Cash ABC vs. US Dollar (Bitfinex)

- Bitcoin vs. Euro (Bitfinex)

- Bitcoin vs. Great British Pound (Bitfinex)

- Bitcoin vs. US Dollar (Bitfinex)

- Bitcoin vs. Chinese Yuan

- Litecoin vs. US Dollar (Bitfinex)

- Litecoin vs. Euro (Bitfinex)

- Ethereum Classic vs. US Dollar

- Ethereum Classic vs. Euro

- Ethereum vs. US Dollar (Bitfinex)

- Ethereum vs. Euro (Bitfinex)

- Ethereum vs. Great British Pound (Bitfinex)

- Dashcoin vs. US Dollar (Bitfinex)

- Dashcoin vs. Euro (Bitfinex)

- Bitcoin Gold vs. US Dollar (Bitfinex)

- Ripple vs. US Dollar (Bitfinex)

- Ripple vs. Euro (Bitfinex)

- Monero vs. US Dollar (Bitfinex)

- Yuan Chain Coin (YCC)

- Zcash Vs. US Dollar (Bitfinex)

- Cardano Vs. US Dollar (Bittrex)

- IOTA Vs. US Dollar (Bitfinex)

- NEO Vs. US Dollar (Bitfinex)

- Stellar Vs. US Dollar (Bitfinex)

Trade crypto CFDs on TradedWell

Fees

As part of trading on TradedWell, spread and swap fees are charged, which vary depending on the instrument traded and the account type opened. The spreads for popular products such as EUR/USD are average:

- Silver from 2.8 pips

- Gold from 2.0 pips

- Platinum from 1.8 pips

For non-Islamic accounts, overnight funding or “swap” fees are charged on positions that remain open overnight (22:00) GMT. If positions are held over the weekend, a three-day swap fee is charged on Wednesdays.

Conversely, TradedWell offers Islamic forex accounts that comply with Islamic religious principles. Islamic accounts are free of any overnight fees during the first 5 days a position is opened. On the 6th day, a storage fee of 10 USD / lot per night is charged, with the fee reaching triple if the overnight order falls on a weekend day.

Similarly, certain international accounts are swap free during the first 5 days. On the 6th day, a storage fee of 10 USD / lot per night is also charged, with the aforementioned weekend rule applying in the same way.

There is also an inactivity fee. Customer accounts where no trades have taken place for a period of more than 60 calendar days are considered dormant accounts. Due to this, a dormancy fee will be charged in the following amount:

- from 61 to 90 days: 160 EUR

- 91 to 180 days: 120 EUR

- 181 to 270 days 200 EUR

- Over 271 days 500 EUR

Payment methods

At TradedWell you can choose from a variety of payment methods, namely:

- VISA

- VPAY

- Verified by VISA

- Mastercard

- Maestro

- Mastercard Secure Code

- Skrill

- NETELLER

Open an account

The account opening process of TradedWell is very simple and intuitive, so even beginners should not have any difficulties opening an account. You need to go through the following steps:

- Enter login information. Enter your name, email address, phone number and create a password for your account.

- Additional personal information (KYC): Here you must enter all the information that will be asked.

- Questionnaire: TradedWell will ask you various questions about, among other things, your trading experience.

- Upload documents: Upload all the required documents as part of the KYC.

- Trading: You can deposit money and start trading or use the practice account first.

Once you are registered, you will have access to a practice account with $100,000 in virtual money to test out your trading skills. The practice account is initially available for up to 360 days, and can be extended upon request to the account manager. When you feel ready to trade live, simply click the “Start” button on the account labeled “Live”.

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.

Conclusion

Our research has shown that TradedWell is a reputable and safe CFD broker. The broker is regulated by CySEC with license number 298/16 and takes numerous measures to protect the client. On the other hand, TradedWell offers a large amount of educational material and a 360 days+ practice account to be the suitable choice for beginners. Last but not least, there is a large number of CFDs available with 300+. Included in this are 24 different trading pairs for CFDs on cryptocurrencies.

**Risk Warning: FX/CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82.78% of retail investor accounts lose money when trading CFDs with this Provider. You should consider whether you understand how FX/CFDs work and whether you can afford to take the high risk of losing your money.