In this article we introduce the online trading platform ROInvesting and examine whether the broker is a trustworthy and safer alternative to other brokers, such as eToro or Plus500. In particular, we try to answer the question of whether ROInvesting is a reputable provider of CFDs on cryptocurrencies.

About ROInvesting

ROInvesting is a multi-asset trading platform specializing in contracts for difference (CFDs) in Forex, Stocks, Indices, Precious Metals, ETFs, and more recently, CFDs on cryptocurrencies. The broker was founded in Cyprus in 2015. The Company behind the platform is authorised and regulated by the Cyprus Securities and Exchange Commission under the license number 269/15. The Cyprus Securities and Exchange Commission (CySEC) based there has granted ROInvesting a license to operate, which is a strong characteristic of a reputable broker.

For experienced traders, the wide range of tradable assets can be of great advantage. Even beginners with a minimum deposit of 250 USD do not have a major entry barrier. If you are interested in the financial market in general and not just cryptocurrencies, you can trade Forex CFDs as well as indices, stocks, commodities, metals and ETFs on the platform with a single account. Depending on the market and asset value, ROInvesting offers traders access to leverage (from 1:2 for cryptocurrencies, to 1:500 for professional traders).

Newcomers should also be pleased that ROInvesting offers a demo account where all functions can be tried out. The demo account is free of any risk as only virtual money is traded. However, the demo duration is limited to 14 days.

Most important info

✅ Website address: https://www.roinvesting.com/

✅ CFDs: Cryptocurrencies as well as foreign exchange, stocks, indices, commodities, ETFs

✅ Leverage: up to 1:30 (for private customers)

✅ Minimum deposit: $250/€215/£200

✅ demo account: Yes, 14 days

✅ Deposit and withdrawal methods: Bank transfers (SEPA and SWIFT), credit cards (Visa, Mastercard, Maestro), Skrill, Neteller

**Warning: 86% of our retail investor accounts lose money when trading CFDs.

Is ROInvesting safe and recommendable?

Apparently there are some good reasons why the official partner of the AC Milan football team is a good and secure option for trading crypto CFDs. As mentioned earlier, the broker is licensed by the Cyprus Securities and Exchange Commission. It is also worth noting that ROInvesting is part of an investor compensation scheme in accordance with its operating licence. Although some clients are excluded, this is a clear advantage over other brokers who do not offer this protection mechanism.

In addition, as is customary for reputable brokers, ROInvesting separates client funds from its corporate funds so that users’ funds cannot be used to pay administrative or operating expenses. In addition, the broker places great emphasis on cyber security and has installed firewalls and Secure Sockets Layer (SSL) software to protect users’ data while communicating over the Internet. The platform’s trading servers are physically located in SAS 70 certified data centers. No hack has ever been reported since the site was launched, so ROInvesting has a very good reputation in the context of security and reliability.

Another advantage is the easily accessible support and a comprehensive range of training courses. Inquiries from users are answered five days a week, from 09 to 22 o’clock.

Account types with ROInvesting

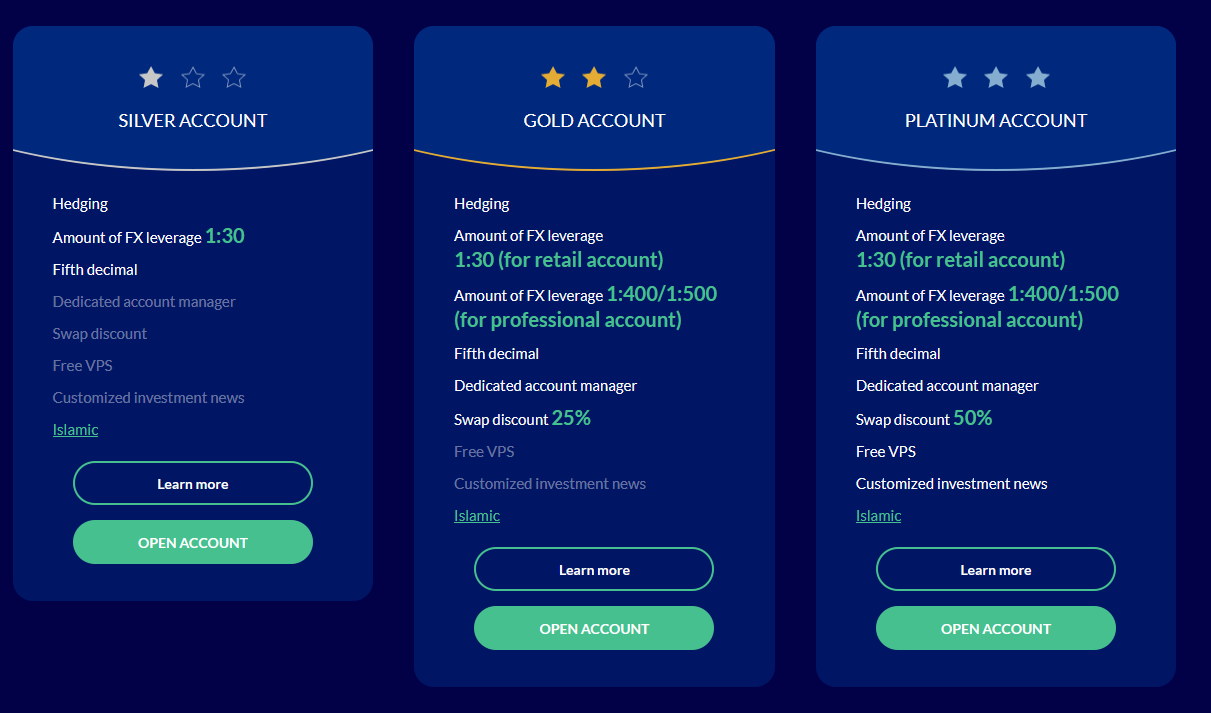

With ROInvesting, private clients can choose between three different account types:

- Silver: is the basic version and offers all essential trading functions with an FX leverage of 1:30 and trading on the fifth decimal place.

- Gold: offers professional traders the opportunity to benefit from FX leverage up to 1:400/1:500 and also offers a 25% swap discount.

- Platinum: is the highest level for private clients and also allows professional accounts to trade with a leverage of up to 1:400/1:500, although there is a swap discount of 50%.

To become a professional trader with ROInvesting, clients must meet at least two of three requirements from the following list:

- The size of the investment portfolio, which consists of financial instruments and cash deposits, exceeds EUR 500,000.

- The client has completed at least ten high-volume transactions per quarter in the market in relation to the same quarter of the previous year.

- The client had been (or still is) active in the financial sector for at least one year.

You should also note that both accounts have certain advantages and disadvantages, although it is pleasing to note that both account types offer “protection against negative balance”. Furthermore, the “margin-closeout limit”, i.e. the percentage that the broker is obliged to close one or more active positions, is different

| Basic account | Professional traders | |

| Protection against negative balance | Yes | Yes |

| Margin Closeout Rule | 50 % | 15 % |

| Access to competitions and other benefits | No | Yes |

| Access to VIP Platinum Training | No | Yes |

| Entitled to compensation from ICF | Yes | No |

Platforms for trading on ROInvesting

Webtrader

The WebTrader platform can be accessed directly via a browser. It offers all the possibilities offered by ROInvesting, from the analysis of the financial markets to the exploration of options, portfolio diversification and the execution of trading transactions with just a few clicks. The user interface allows you to set different trading strategies, define entry and exit points, and perform all the same functions as the MetaTrader 4 platform.

MetaTrader 4

MetaTrader 4 is a software that must be downloaded and installed. You can then trade on ROInvesting from your desktop PC or laptop. As on the WebTrader platform, you can open and close trades, set stops and entry limits, and perform technical analysis. All transmitted data is securely encrypted and the platform makes trading fast and easy.

Mobile app

ROInvesting’s mobile app is available for iOS and Android based devices and is powered by the technology engine of MetaTrader 4. So you can use your smartphone or tablet and have full access to all functions. The app also offers nine possible time frames, news about trading conditions, one-tap actions, an online chat and push notifications.

**Warning: 86% of our retail investor accounts lose money when trading CFDs.

Available CFDs on cryptocurrencies

ROInvesting offers a total of 21 different cryptocurrencies, which can be traded either against the US Dollar (USD), Euro (EUR) or the British Pound (GBP). However, you should be aware that ROInvesting only offers CFDs on cryptocurrencies and not “real” Bitcoin and Co. However, this has clear advantages.

CFDs do not require traders to own the cryptocurrency themselves in order to benefit from volatility. As a result, you don’t have to worry about keeping Bitcoin, Ethereum or other Altcoins in a wallet. This also makes your investment much less vulnerable to hacks, especially considering the high security of ROInvesting. Below you will find the list of available cryptocurrencies:

- Cardano vs. USD

- Babel vs. USD

- Bitcoin SV vs. USD

- Bitcoin vs. EUR, GBP, USD

- Bitcoin Gold vs. USD

- Dash vs. EUR, GBP, USD

- Ethereum Classic vs. EUR,GBP, USD

- Ethereum vs. EUR, GBP, USD

- IOTA vs. USD

- Lisk vs. USD

- Litecoin vs. EUR, GBP, USD

- NEO vs. USD

- Quantreum vs. USD

- Swisscoin vs. USD

- Tether vs. USD

- NEM vs. USD

- Stellar vs. USD

- Monero vs. USD

- Ripple vs. EUR, GBP, USD

- Forget vs. USD

- Zcash vs. USD

It is important to know that CFDs on cryptocurrencies can only be traded with a leverage of 1:2 due to the regulations of the European Securities and Markets Authority, in short: ESMA, which apply to all brokers offering their services within the European Union. This applies to both the basic account and professional traders.

**Warning: 86% of our retail investor accounts lose money when trading CFDs.

Fees and expenses

ROInvesting offers all investors a free registration. In addition, there are no commissions for trades, as ROInvesting as a market maker earns its profit exclusively through spreads. The amount of the spread depends on the traded financial instrument or account type. The asset list on the website provides an overview of the minimum spreads. Here you can find the minimum spread, ordered by asset class. You will also find a sorting by account type. You will notice that traders with a Platinum account benefit from quite favourable spreads, whereas the spreads for the Silver account are significantly higher.

You should also know that ROInvesting charges fees for inactivity and for payouts. If you are at least 61 inactive, you will be charged 80 Euros each for the first two months, after that 120 Euros per month will be charged from the third month onwards. If you are inactive for at least 301 days, the broker will charge a hefty fee of 500 EUR per month, so you should close your account immediately if you no longer use it.

If you wish to make a withdrawal, there are no fees unless the withdrawal is less than 100 Euros or for withdrawals from inactive accounts. In this case, a fee of 50 EUR will be charged. For more information on fees, including calculation examples, please visit the ROInvesting website. By the way, the following payment methods are available for deposits and withdrawals:

- Debit/credit card (Visa and MasterCard)

- Bank transfers (SEPA and SWIFT)

- eWallets, like Skrill and Neteller

Create an account with ROInvesting

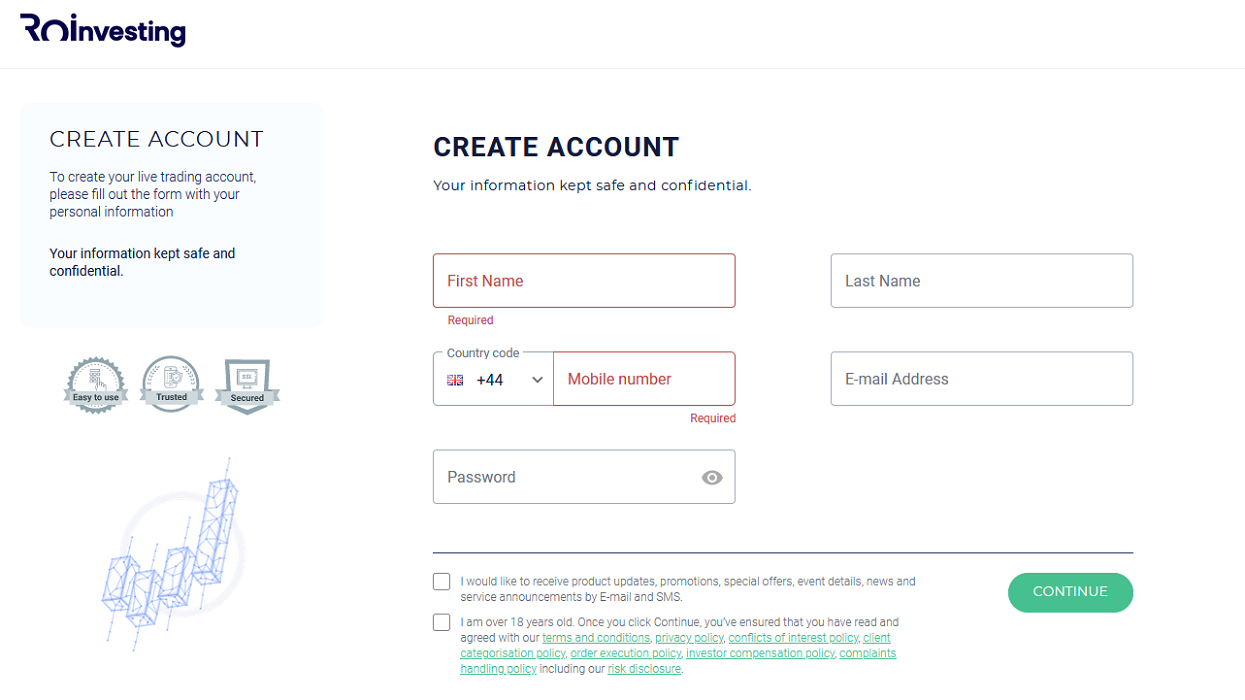

Creating an account (Silver) with ROInvesting is very simple and straightforward. To create a new account you have to follow these steps:

- Go to the official ROInvesting website and click on the “Open Account” button located in the top right-hand corner.

- Give the necessary data: name, mobile number, e-mail address and a password and click on “Open Account”.

- Then you have to enter your date of birth and an address.

- Answer the questions ROInvesting is now asking you. These are required by the regulatory provisions of the CySEC.

- Provide your tax information and confirm whether you are a politically exposed person (PEP) or not

Verification of your ROInvesting account

The broker then checks the information you have provided. Furthermore, you must also carry out a verification, in the course of which ROInvesting requires proof of your identity and proof of residence. For the former you can use a driver’s license, national identity card, passport or residence card, which you must scan and upload. For proof of residence, you can use a bank statement, invoice or document from a government agency.

Once submitted, the documents are reviewed by the ROInvesting compliance team. This process usually takes no longer than 48 hours, but it can take longer depending on the volume of requests.

Limits for incoming and outgoing payments on ROInvesting

Depending on the payment method, there is a minimum and maximum deposit value. Usually, the minimum deposit is €250, while the maximum varies between €5,000 and €30,000. However, before you make a deposit, you will be shown this amount.

Supported countries

You should note that ROInvesting unfortunately does not support all countries worldwide. However, there are very few exceptions. You can open an account with the broker if you live in the EU, UK and some other countries. The only exceptions are the United States of America and the countries sanctioned by the UN.

Conclusion: Is an investment with ROInvesting recommendable?

Our test has shown that ROInvesting is a serious and good broker, where you can trade cryptocurrencies in addition to classic financial products such as CFDs on indices, stocks, commodities, metals and ETFs. The offer is more extensive with 21 different cryptocurrencies compared to other brokers like eToro.

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.

Another positive aspect is the very good and extensive customer support, which can be reached via live chat, e-mail or even a free hotline. Beginners can also use the demo account and familiarise themselves with the trading platform for 14 days. Therefore, we can absolutely recommend ROInvesting as a broker for crypto CFDs.

**Warning: 86% of our retail investor accounts lose money when trading CFDs.