Ethereum Classic (ETC) is a hard fork from Ethereum that was released in the summer of 2016 after the DAO Hack took place. After this event, the Ethereum community split into two camps. The smaller group around Ethereum Classic insisted on the codex “Code is law“, according to which everything that happens on the blockchain should be unchangeable.

Since the hack and the spin-off, Ethereum has been in the limelight. However, Ethereum Classic can also boast some positive developments. Accordingly, it may be interesting to invest in ETC. In the following article we will therefore introduce you to the best options for investing in Ethereum Classic (ETC). For this we introduce you to different cryptocurrency exchanges and brokers, and give you a recommendation to our favorites for the purchase of ETC to the hand.

Before you read the individual instructions, you should make an important decision about the storage of your Ethereum Classic (ETC). Depending on your decision, we will give you a recommendation where to buy Ethereum Classic. At the end of the article you will also learn how to create a free Ethereum Classic Wallet.

Choose the best exchange or broker

It’s your call: Do you want to keep Ethereum Classic yourself and have full control over your asset or are you looking for a simple solution and handing over the responsibility to a broker? Then you also have the opportunity to invest in Ethereum Classic CFDs.

When answering this important question, you should consider the following: By giving responsibility to an exchange or broker, you are also giving up control over your cryptocurrency. Therefore it is from our point of view better to manage Ethereum Classic yourself, because only you have access to your asset via your Private Key. Since exchanges and brokers are popular targets for hacker attacks, we believe it is also safer to manage the ETC yourself.

The third option is to buy cryptocurrency CFDs. You should know, however, that you do not own the cryptocurrency. You own a CFD which is only a certificate (CFD) on a rising (long) or falling price (short). From our point of view, the following possibilities and recommendations therefore arise:

- If you would like to manage Ethereum Classic (ETC) yourself, we recommend Kriptomat and Litebit. On both plattforms you can buy ETC via Euro (with SEPA, SOFORT, credit card, …) and send it immediately to an external wallet.

- If you want to buy “real” Ethereum Classic (ETC), but are looking for an easy and simple solution where you don’t want to set up a wallet, you can buy the ETC Coins on eToro and keep them there.

- If you want to buy Ethereum Classic with leverage, ETC CFDs are the best choice for you. Our recommendation is eToro.

✅ Deposit protection for capital employed

✅ Acting with a lever

✅ No wallet setup required

❌ no possession of a real cryptocurrency

❌ Cannot be used as a means of payment in everyday life

✅ Freedom and independence from third parties (exchanges, brokers)

✅ Lower fees for long-term investors

✅ no obligation to make additional contributions (only total loss possible)

❌ higher time expenditure for setting up the external wallet

❌ No deposit protection

**68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.

Below you will find the corresponding instructions for our favorite exchanges and brokers: Kriptomat, Litebit, Coinbase, eToro and Binance.

Buy and sell Ethereum Classic on eToro

Account setup, verification and limits

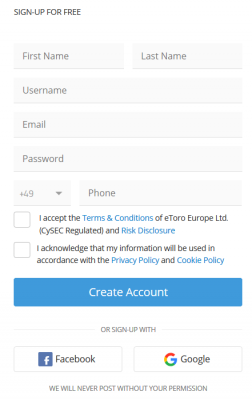

The biggest and best known broker to buy ETC is eToro. Like Coinbase, the platform also offers deposit protection up to a value of 20,000 USD per customer. Even if the company is hacked, your assets (up to 20,000 USD) are safe. First you have to go to the official website etoro.com (click this link!)*. Then you can click on the green button “Register now”. Then a new window will open where you have to enter your first and last name, e-mail, password, phone number and a username.

Once you have successfully done this, you will also need to accept the Terms of Use and Privacy Policy. Then you can click on the blue button “Create account”. That’s how quickly you set up an account with eToro.

>> Buy and Sell Ethereum Classic on eToro** <<

**68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.

Limits for the purchase of ETC on eToro

Your current account has not yet been verified and is therefore subject to a deposit limit of 2,000 Euros. Only after complete verification of your personal data your trading limits – which also depend on the payment method – will rise:

In order to use these limits, you must verify your personal information (including a tax number). This process is necessary in connection with the strict European laws and is already an integral part of almost all exchanges worldwide. Verification, however, is very straightforward and can be done in a few minutes. To perform the verification, you must click on the “Edit” button in your profile. There, the necessary documents are listed that must be submitted in order to activate the above-mentioned limits.

Afterwards you can deposit your desired amount without any restrictions. All you have to do is go to “Deposit money” in the lower left corner and enter your preferred payment method. Depending on the type of deposit (see table above), the credit will be either slightly faster or slower.

Minimum deposits and fees

When trading on eToro, you should consider the following points:

- All trading accounts are maintained in US dollars (and not euros). That’s why your deposit will be converted into US dollars immediately. This is done at the current exchange rate, but please note that there is a conversion fee.

- The minimum deposit for all deposits other than the first deposit must be at least USD 50. A minimum of 500 USD is required for deposits made by bank transfer.

- A withdrawal handling fee will be charged for withdrawals. You will see the respective withdrawal fee in the cashier area after you have entered the withdrawal amount. For payouts greater than 50 USD, this is 5 USD.

Buy Ethereum Classic on eToro

As explained above, eToro has the unique feature that the platform offers both “true” Ethereum Classic and Ethereum Classic (ETC) CFDs.

In contrast, all buy positions with leverage are executed as CFDs. CFDs are so-called derivatives – a security whose value or performance depends on the performance of one or more underlying assets. They are specialized and popular over-the-counter (OTC) financial products that allow traders to easily open positions in a variety of different financial markets. The underlying asset – Ethereum Classic – is not acquired by the investor. You will only receive a certificate on it.

Buy the cryptocurrency ETC

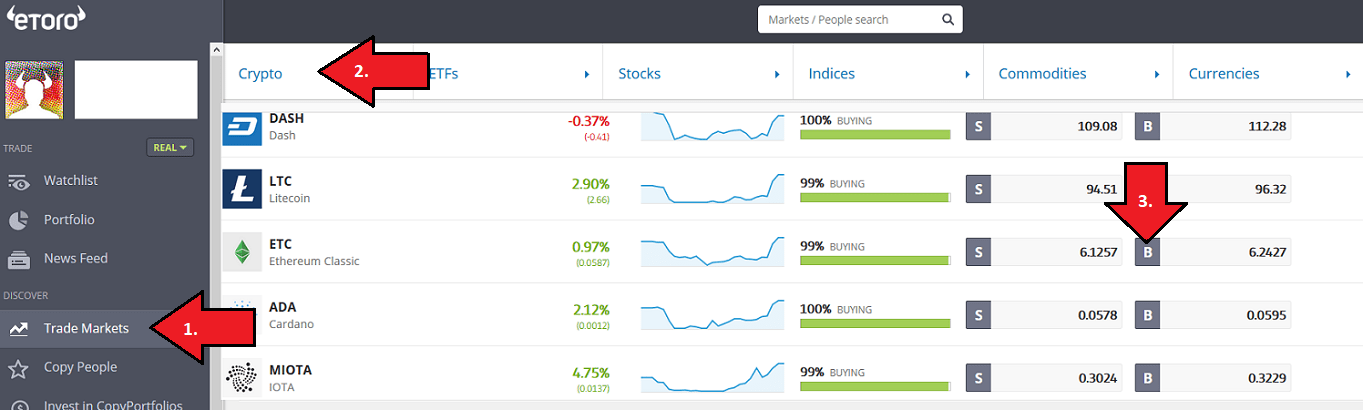

eToro currently offers 15 different cryptocurrencies for trading, including Ethereum Classic. To buy ETC, you must first click on “Trade Markets” and then on “Crypto”. The following overview is then relatively self-explanatory.

The letter “B stands for buy Ethereum Classic (step 3) and “S” for sell Ethereum Classic. Click on the “B” in the ETC line to start the purchase.

Then you only have to enter the amount of Ethereum Classic you want to buy. Then click on “Buy” (without changing any other setting) and your transaction will be completed within a few seconds. The Ethereum Classic will then appear in your “Portfolio”.

>> Buy and sell Ethereum Classic on eToro** <<

**68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.

Buy ETC CFDs

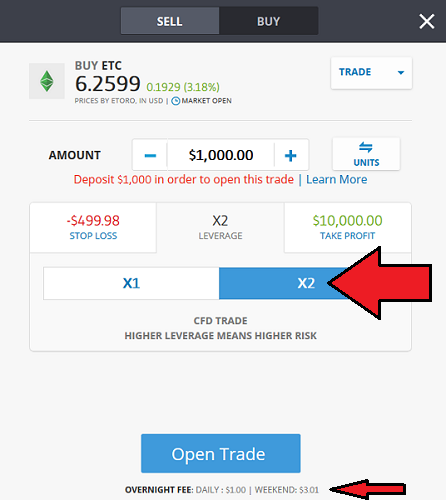

The purchase of Ethereum Classic CFDs works very similar on eToro. To buy CFD you must also click on “B” to buy Ethereum Classic. After that you get to the familiar overview.

Here you define the amount of money you want to invest in this trade. Then you have to adjust the lever multiplier “X2”. For cryptocurrencies, eToro does not currently offer any major leverage. You should then check your Stop Loss and Take Profit settings. A stop-loss limit is very important to limit the possible risk. Then you can open the trade. This is executed immediately when the market is open.

Stop Loss means that you close a trade if the ETC price reaches a fixed market price or an amount of money that you can set. Take Profit determines when your trade is automatically closed when the profit of your trade reaches the amount you have chosen. It is also important to note that eToro charges overnight fees (also known as rollover fees). Those appear at the bottom of the pop-up window (see screenshot).

>> Buy and sell Ethereum Classic on eToro** <<

**68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.

The eToro wallet

Since March 2019 eToro offers the possibility to manage single cryptocurrencies – Bitcoin, Bitcoin Cash, Ethereum, Litecoin and XRP – on a mobile wallet (an app). The app makes it possible to withdraw your own “real” cryptocurrencies from the exchange and send them to an external wallet. Unfortunately, Ethereum Classic cannot yet be managed via the eToro Wallet. But we will inform you as soon as possible!

Is eToro safe and recommendable?

From our point of view, this question is very important because the management of private keys is delegated to a broker. The user gives the control over his own assets to a third party, here: eToro! This makes it all the more important that the broker is reputable and trustworthy.

From our point of view, this is clearly the case with eToro. Customer funds are usually well protected when the broker is supervised by a regulatory authority. eToro is controlled by two regulatory authorities that are considered to be very accurate and strict in professional circles:

- CySEC: As eToro has part of its registered office in Cyprus, the Cypriot CySEC is responsible for monitoring.

- FCA: As eToro has also established a subsidiary in the UK, FCA in the UK is also responsible for the control of eToro.

The broker also actively protects customer deposits by keeping them separate from the company’s assets. Even if the broker were to become insolvent, the customer’s funds would not flow into the insolvency estate.

>> Buy and sell Ethereum Classic on eToro** <<

**68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorised and regulated by the Cyprus Securities and Exchange Commission.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Buy Ethereum Classic on Kriptomat

About Kriptomat

Although Kriptomat is far from being as well known as eToro, the comparatively young crypto exchange is in our opinion a very good option to buy cryptocurrencies. The platform currently offers over 30 cryptocurrencies for purchase via SEPA bank transfer, credit card, Zimpler and Neteller. A big advantage over eToro is also that you can send the ETC to an external wallet without any detours (unlike eToro).

According to the exchange’s motto “crypto for everyone” the focus of the exchange is on usability, which you will clearly notice when using the exchange for the first time. The dashboard has a simple but modern design to allow really everyone, regardless of experience level, to buy cryptocurrencies.

However, we do not mean to say that Kriptomat is only recommended for beginners. In our opinion, there are good reasons for long-term investors to use the exchange. As far as seriousness is concerned, Kriptomat can convince with two licenses from the government in Estonia, for sale and for custody. If this does not convince you, perhaps the argument of fees does. Unlike other exchanges and brokers, Kriptomat does not charge a price premium, the notorious, opaque “spread”. With Kriptomat, the purchase price is the same as the spot price of Ethereum Classic (ETC). The exchange charges only a transaction fee, which you can see in the table below.

| Transaction | Fee % | Minimum |

|---|---|---|

| SEPA (Euro to crypto) | 1.45% | 1,45 EUR |

| Zimpler | 2,89 % | |

| Skrill | variable | |

| Neteller | variable | |

| SEPA sell (crypto to Euro) | 1,45% | 1,45 EUR |

| Credit card >100 EUR | 3,65 % | |

| Credit card <100 EUR | variable |

>> Buy Ethereum Classic on Kriptomat* <<

Registration and verification with Kriptomat

As the exchange is based in Europe (and focuses primarily on customers from Europe), the exchange is subject to the strict legal requirements of the European Union. Therefore Kriptomat also requires extensive verification of its customers (as with a bank account or even eToro). Even before you buy, you have to register and fully verify. To do so, go to the official website kriptomat.io* and click on the orange “Register” button.

At the beginning you only have to enter your first and last name, an e-mail address and a password. After submitting your data, you will receive an e-mail from Kriptomat containing an activation link for your Kriptomat account. After confirmation, you can then log in. This was just the beginning of the registration process.

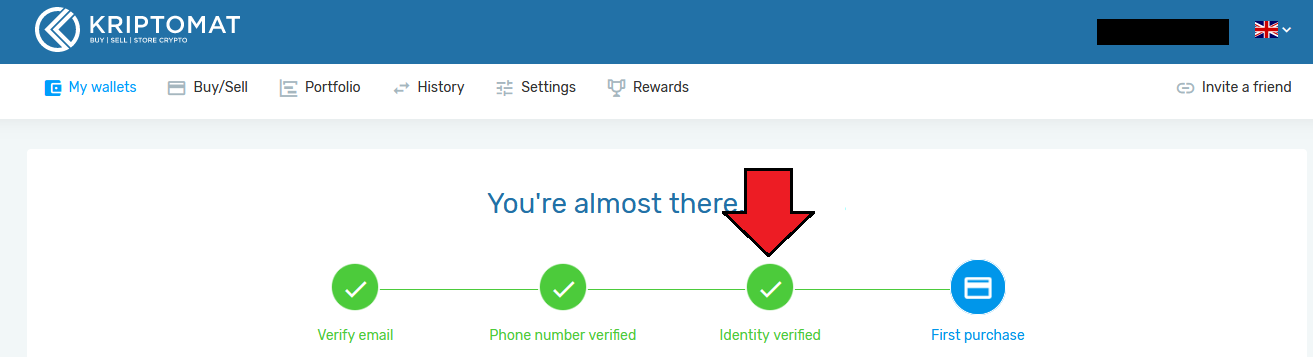

Before you can buy Ethereum Classic (ETC), European laws require you to provide a lot more information and upload proofs. Start with your telephone number. After entering it on the website, Kriptomat will send you an SMS containing a verification code to check whether the number actually belongs to you (step 2 of 4). Afterwards, step 3 asks for your personal data (see screenshot).

In this step you enter your address (street, house number, city, country) and verify it with a photo or a scan of your passport or ID card. To make this process as quick and easy as possible, Kriptomat has developed a solution that allows you to continue the registration process on your smartphone (when you register on your desktop PC). You can simply take a picture of your ID and upload it to Kriptomat. The same applies to the final step, a selfie from you. This completes step 3 of 4 of the registration process. You now have the following limits:

| Transaction | Limits |

|---|---|

| Daily deposit and withdrawal via SEPA | 25,000.00 EUR |

| Monthly deposit and withdrawal via SEPA | 200,000.00 EUR |

| Deposit and withdrawal in cryptocurrencies | no limit |

| Daily limit for other payment methods | 500.00 EUR |

| Monthly limit for other payment methods | 5,000.00 EUR |

As you can see in the table, you must make a deposit via SEPA if you want to buy higher amounts (> 500 euros a day) and benefit from the lowest fees. This is what step 4 of 4 of the registration is for. It is necessary that you link your Kriptomat account with your bank account. Only then you can deposit money via SEPA. For the other payment methods: Neteller, Skrill and credit card, this step is not necessary. The following tutorial provides a good overview of the entire verification process:

>> Buy Ethereum Classic on Kriptomat* <<

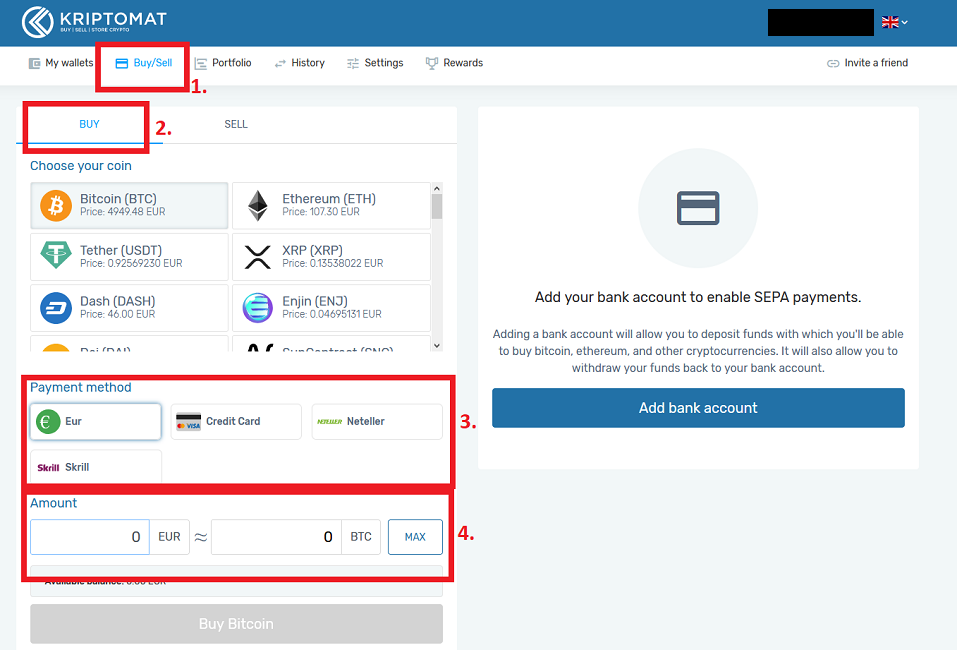

Buy ETC on Kriptomat

Buying Ethereum Classic (ETC) on Kriptomat is very easy and should not be a big challenge even for people who have never bought cryptocurrencies before. First go to “Buy / Sell” in the main menu (step 1) and then select the tab “Buy” (step 2). In the area below you can now search for and click on Ethereum Classic (ETC).

You can then choose from four different payment methods (step 3). In the fourth step (see screenshot), all you need to do is enter your purchase amount for Ethereum Classic (ETC). After you click on “Buy Ethereum Classic”, you will see the transaction fees that apply to your order. To complete the purchase, you need to click “Confirm transaction”. The purchase is now complete and you will be redirected to your “My Wallet” section. Normally, ETC should be displayed here within a few seconds. A good summary of the purchase process is also provided in the following video tutorial:

>> Buy Ethereum Classic on Kriptomat* <<

Buy Ethereum Classic on Litebit

Guide: Buy ETC on litebit.eu

The Dutch exchange Litebit.eu is a very reliable and customer-friendly exchange, which is somewhat less well-known, but no less good. We have been a Litebit customer for several years and have had very good experiences with the platform and the customer support. In addition, the safety standards are very high in terms of quality. Litebit.eu is therefore from our point of view the first choice in Europe to buy Ethereum Classic by SEPA transfer, SOFORT, credit card or GiroPay.

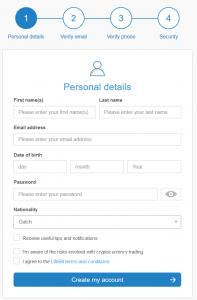

The first step is to create a new account at the exchange. For this you have to visit the website of litebit.eu (click!)*. To register, simply click on the “Register” button. Since you will be making Fiat money transactions on your account, Litebit is legally obliged to request and verify some personal information. This is mandatory under European legislation (know-your-customer and anti-money laundering).

Once you have entered all the details (see screenshot), you can click the “Create account” button. You will then receive an email with a confirmation code. You must enter the code on the Litebit website to verify your email. In the next step Litebit will also ask you for your phone number and subsequent verification. For this you will receive a code via SMS, which you also have to enter on the website. Finally, you need to set up two-factor authentication. The default setting for LiteBit is two-factor authentication via SMS. The exchange also offers you the possibility to secure your account with the Google Authenticator (if you already use the app somewhere else).

We have had very good experiences with both solutions. Litebit will then automatically redirect you to the homepage of the exchange. Now you can log in to your account for the first time. Click on “Log in” and log in with your new access data.

>> Buy and sell Ethereum Classic on Litebit* <<

Limits for the purchase of Ethereum Classic

Litebit has different levels of verification and associated limits on how much you can buy daily, weekly or monthly in cryptocurrencies. Through the registration process described above, you already meet the requirements for the first level – Tier 1. This allows you to invest 350 Euro per day, 1.050 Euro per week and 4.200 Euro per month. If you want to increase these limits, you have to unlock more levels (“Tiers”) step by step. The following table gives you an overview of the verification levels:

Depending on the payment method, the maximum amounts also differ once again:

Level 2 (“Tier 2”) is the address verification. Level 2 requires you to scan and upload the front and back of your ID card. You must also prove your place of residence, for example by uploading an electricity or mobile phone bill to Litebit.eu as evidence.

Level 3 (“Tier 3”) is the ID verification. At this level, a Litebit representative will contact you via Skype in a video call so you can confirm your identity with your ID card. In “Tier 3” you can buy cryptocurrencies up to a limit of 500.000 Euro per month.

Buy ETC by SEPA, SOFORT or credit card

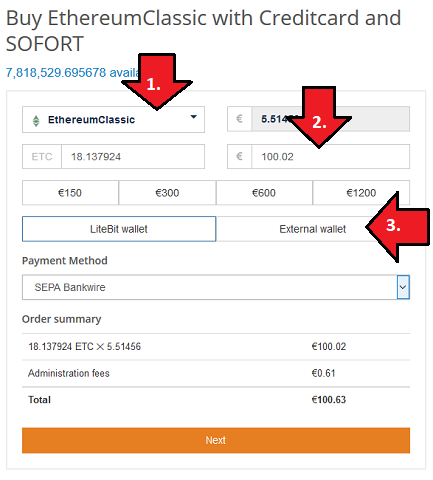

The actual purchase of Ethereum Classic (ETC) is very simple and quick. You simply click on the “Buy” tab in the upper menu and then select Ethereum Classic in the drop-down menu (step 1 in the picture).

Then you can choose the amount in Euro you want to buy (step 2). Now you have to decide if you want to use the Litebit Wallet or an external Wallet. If you choose the Litebit Wallet, click on “Litebit Wallet”. If you want to use an external wallet, select “external wallet” and enter your ETC reception address (step 3 in the picture). The “Receive Address” is your ETC Wallet address. Of course you also have the possibility to send the ETC to an external wallet later. So you don’t have to worry that your coins are “trapped” on the exchange.

The wallet of Litebit is secure as long as you have activated the SMS or the 2-factor authentication via Google Authenticator. Nevertheless, exchanges and brokers were hacked in the past and large amounts of cryptocurrencies were stolen. As a better alternative we recommend a desktop or a hardware wallet, like the Ledger Nano X Hardware Wallet. At the end of the article we will also explain how to install a free ETC Wallet.

Now you have to choose a payment method. We recommend that you choose “Sepa Bankwire” as it has the lowest fees. If you choose SEPA, you must transfer the corresponding amount in euros to Litebit’s bank account for a specific purpose. Afterwards it usually only takes up to 24 hours until Litebit has received the transaction and sends the Ethereum Classic to your Litebit Wallet or external Wallet.

>> Buy and sell Ethereum Classic on Litebit* <<

Buy Ethereum Classic on Coinbase

About Coinbase

Coinbase is one of the largest cryptocurrency exchanges worldwide and is active in over 100 countries with more than 20 million customers. The American exchange is one of the oldest exchanges on the crypto market. In the beginning Coinbase was just a Bitcoin broker where you could buy Bitcoin. In recent years Coinbase has continued to expand its service.

Coinbase now offers the purchase and sale of cryptocurrencies by credit card, debit card and bank transfer. Since 2018 Coinbase has also been offering a wallet service via a mobile wallet for iOS and Android. In addition to the brokerage platform, there is also Coinbase Pro. This is an exchange aimed at experienced investors. Coinbase Pro allows users to actively trade cryptocurrencies. The fees are significantly lower than for the brokerage service. There are also advanced trading options.

Coinbase is particularly popular among beginners worldwide, as it is fully regulated and licensed in the USA. The company also offers deposit insurance for all customer deposits held online at Coinbase. If Coinbase were to suffer a hack, the insurance policy would cover the lost customer funds.

>> Buy and sell Ethereum Classic on Coinbase* <<

Approved countries – Is it legal to trade on Coinbase?

Since Coinbase actively cooperates with regulatory authorities worldwide and takes into account the specific laws of each country, not all individuals worldwide are (officially) entitled to use Coinbase. Besides, not all cryptocurrencies are available in every country. Currently 103 countries are approved.

Payment methods and fees

Coinbase’s payment methods and fee structures are somewhat difficult to understand and vary from country to country. In principle, the following payment methods are accepted:

- Bank Transfer (including ACH in the USA and SEPA in the EU)

- credit card

- debit card

- PayPal (payout only)

Coinbase determines the exchange rate by adding a margin or spread to the market rate of Coinbase Pro (“Pro Exchange Rate”). In addition, Coinbase also charges separate fees (in addition to the spread), which are either a flat fee or a percentage of the transaction. The fee structure for this is as follows:

- There are no fees for bank transfers.

- A fee of 3.99 percent of the transaction amount is charged for credit card payments.

- A fee of 1.49 percent of the transaction amount is charged for purchases made with Coinbase credit.

- A flat fee of 0.15 Euro will be charged for payment / transfer from Coinbase to a bank account.

- Transactions between Coinbase accounts are free of charge.

Coinbase also charges an additional fee for smaller purchases. The flat rates are listed below. If the transaction amount …

- is less than or equal to 10 USD, the fee is 0.99 USD.

- is between 10 and 25 USD, the fee is 1.49 USD.

- is between 25 and 50 USD, the fee is 1.99 USD.

- is between 50 and 200 USD, the fee is 2.99 USD.

It should also be noted that not in every country, all payment methods are allowed. The following table gives European customers an overview (“Buy” = buy crypto directly, “Sell” = sell crypto directly, “Deposit” = pay in local currencies and “Withdrawal” = pay out local currencies) of how cryptocurrencies can be bought or resold on Coinbase.

| Provider | Buy | Sell | Deposit | Withdraw | Speed |

|---|---|---|---|---|---|

| SEPA | ❌ | ❌ | ✅ | ✅ | 1-3 business days |

| 3D Secure Card | ✅ | ❌ | ❌ | ❌ | Instant |

| Ideal/Sofort | ❌ | ❌ | ✅ | ❌ | 3-5 business days |

For US customers, there are different payment methods available:

| Provider | Buy | Sell | Deposit | Withdraw | Speed |

|---|---|---|---|---|---|

| Bank Account (ACH) | ✅ | ✅ | ✅ | ✅ | 1-3 business days |

| Debit card | ✅ | ❌ | ❌ | ❌ | Instant |

| Wire Transfer | ❌ | ❌ | ✅ | ✅ | 3-5 business days |

What are the limits on Coinbase?

In principle, a general answer to this question is not possible. Unlike other exchanges and brokers, Coinbase sets limits individually for each user. In general, however, it can be said that the limits on coinbase can be divided into two levels. Each level activates additional functions. By reviewing certain information you will gain access to higher limits on your Coinbase account. Level 1 requires you to provide proof of your telephone number and ID. To reach level 2, you must verify your complete personal information.

In addition, the limit depends on various other factors:

- payment method

- Age of your account

- History of previous purchases

How high the limits actually are cannot be answered in general terms. However, there are numerous reports on the Internet in which users report on their limits. According to this, the initial limit seems to be 500 USD per week for credit card payments and 1,000 USD per week for bank transfers. If you verify with one document, the limit rises to 9,000 USD, while for two documents it is 15,000 USD. However, these values should only serve as rough guide values. You can find your own limit in your Coinbase account.

>> Buy and sell Ethereum Classic on Coinbase* <<

Buy Ethereum Classic on Coinbase by SEPA or Credit Card

The registration process at Coinbase is very simple and straightforward. To register, you must first visit the official Coinbase website (click here!)*.

Once you have entered your name, email address and password, Coinbase will ask you to confirm your email address via a confirmation link. Coinbase will then ask for your telephone number and will confirm it with a PIN code. The code will be sent to you by SMS and must then be entered on the Coinbase website.

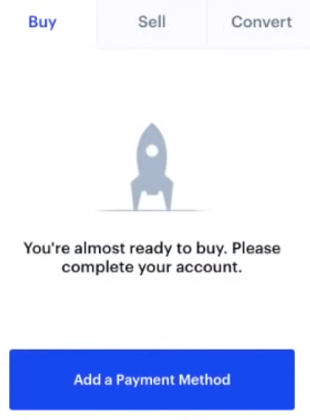

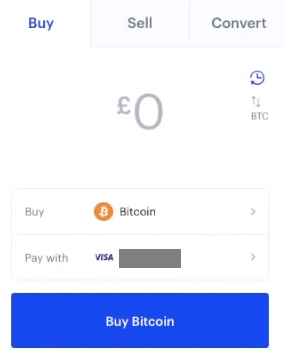

Due to legal requirements worldwide, Coinbase must fully verify your identity and requires the following information: your date of birth, your full address, your profession, name of your employer, the origin of your funds, as well as your investment experience. All other information is not mandatory, but only increases your limit for the purchase of Ethereum Classic, as described above. When you’re done verifying, you can buy Ethereum Classic. This works in the following steps:

- Go to the Buy page by clicking the “Trade” button in the upper right corner.

- Then you will see the following window. Here you can select Ethereum Classic (in this Screenshot Bitcoin is selected per default) and enter the amount you wish to invest in your local currency:

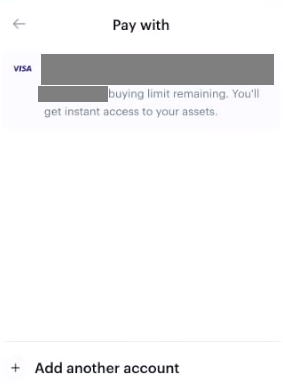

- Below you have to select the payment method under “Pay“. If you have already deposited a credit card, you will see the following window. You also have the option to select a different payment method (e.g. bank transfer). The corresponding limit for the purchase of ETC will be displayed in the window.

- When all details are complete, you can click on “Buy”. The Ethereum Classic (ETC) will now be credited to your Coinbase account within a few seconds.

>> Buy and sell Ethereum Classic on Coinbase now* <<

Trade Ethereum Classic on Binance

Binance is one of the world’s largest and most popular exchanges, which is not only secure but also extremely user-friendly. However, there is a significant restriction when buying cryptocurrencies on Binance. Currently, the Exchange only offers the purchase of Bitcoin, Bitcoin Cash, XRP, Ethereum, Binance Coin and Litecoin by credit card.

This allows you to buy a cryptocurrency, such as Bitcoin, by credit card on Binance and then trade it against Ethereum Classic (ETC). Alternatively, you can buy the other cryptocurrencies from a broker (if you don’t have a credit card) and then trade ETC on Binance against the other cryptocurrency.

The first step is to create an account with Binance. To do this, click on this link (Binance.com) and register*. The process is very fast as there is almost no personal data and evidence (e.g. a copy of identity card, proof of residence, etc.) are required. Unlike many other exchanges, Binance does not require verification (if you want to trade cryptocurrencies). The limit without verification is 2 Bitcoin per day. However, if you need a higher limit of 100 BTC per day, verification is required.

Step 1: Buy Bitcoin by credit card

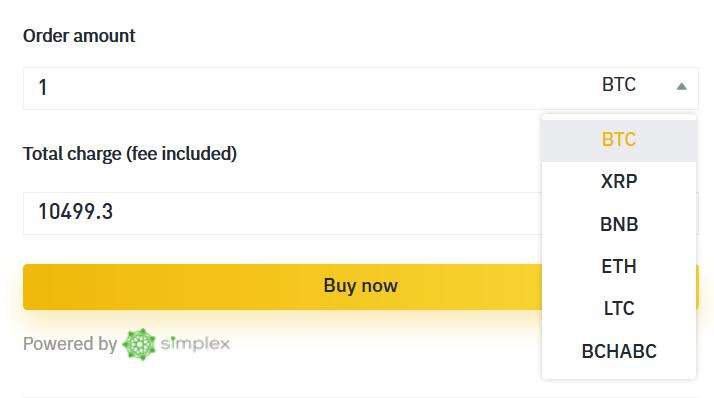

Once you are registered, you can buy Bitcoin by credit card on Binance and trade it against ETC later. The menu item for purchasing Bitcoin by credit card can be found in the right-hand part of the menu under “Medium” and “Buy with Credit Card“. Then you will see the following view. Here you have to select “BTC”.

It is important to know that Binance is working with the third-party provider “Simplex” to process the purchase. In contrast to Binance, Simplex requires verification of the user! The purchase process is relatively self-explanatory. Below we have written a short summary of the individual steps:

- Select “BTC” and the currency you want to pay in (Euro or USD).

- Fill in the fields with the personal data.

- Verify your email and phone number with a code.

- Go back to the website and click “Next” .

- Enter your credit card information.

- Upload your documents to verify your identity (front and back of your passport).

Before and after the purchase there are some things to keep in mind:

- The given Bitcoin amount is based on the current Bitcoin price and is not final, but will be calculated later! If the rate changes by more than +/-2.5%, you will be asked to reconfirm the transaction by email from Simplex.

- Once the payment is complete, you can check your payment status and deposit history on Simplex.

- The Simplex fee is 3.5% per transaction or USD 10, whichever is higher.

- The daily limit is 20,000 USD per user. The monthly limit is 50,000 USD per user.

- The minimum amount (the minimum) for a transaction is currently USD 50.

Step 2: Trade ETC

Once the Bitcoins have arrived on your Binance Wallet, you can start the trade against Ethereum Classic. We will show you exemplary how you can exchange Bitcoin (BTC) for LINK. Alternatively, you can of course transfer Bitcoin from another broker or wallet to Binance. You can send the BTC directly to the wallet address of Binance.

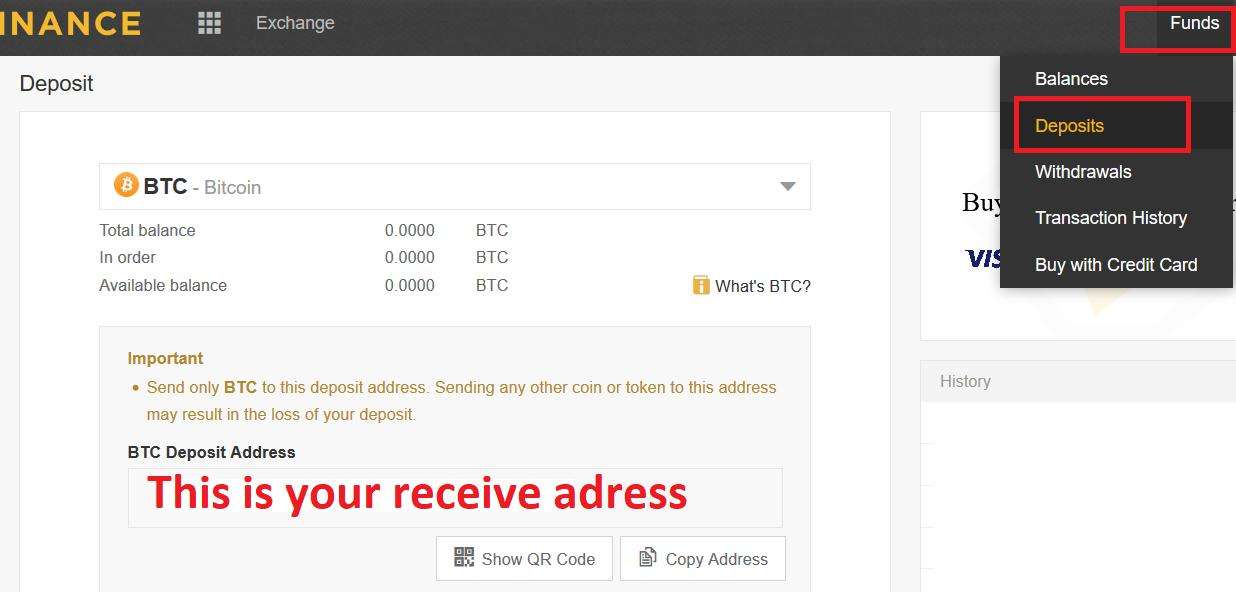

To find out the “Receive address” of your Bitcoin Binance Wallet, click on “Funds” in the navigation bar and then on “Deposit”. You can then enter BTC in the search field and select Bitcoin. A Bitcoin address from your Binance account will then be displayed in the following field. You can enter these in the Litebit purchase process, for example, to send the BTC directly to Binance.

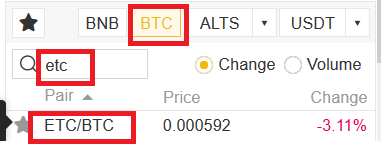

Now your Bitcoins should have arrived on your Binance Wallet. Now there are only two small steps left to buy Ethereum Classic on Binance. In addition to the Binance logo at the top left, there is the menu item “Exchange” and below it “Basic“, select this menu item. Afterwards you get to the following overview (see screenshot below). First you need to make sure that BTC is set as your trading pair (step 1). In the search box below (step 2), type “ETC” and then click ETC/BTC (step 3).

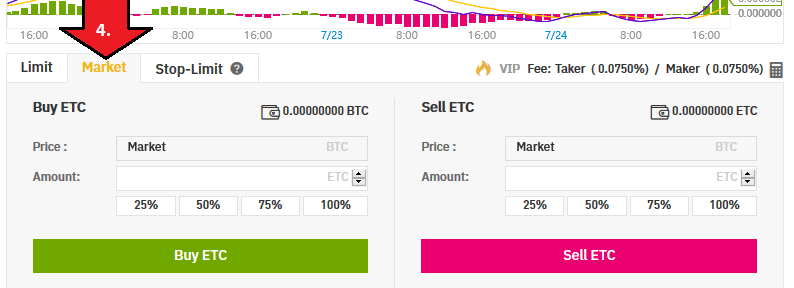

The display below the price chart then changes. You can find a more detailed explanation of Binance’s trading overview in our Binance review and test report (click here!). If you were able to follow the previous steps, you must then decide what type of purchase you would like to make. You can choose between “Limit”, “Market” and “Stop-Limit”.

>> Buy and sell Ethereum Classic on Binance* <<

Step 3: Select Limit, Market or Stop-Limit Order

A “limit” order is an order placed in the order book at a limit price you specify. This means that the trade is only executed when the market price reaches your limit price. If the market price does not reach the price you set, the limit order remains open.

You can delete it if you want. A “limit” order should therefore always be used when you are not in a hurry to buy or sell or want to achieve a certain price. In contrast, a “Market” order is executed immediately at the current market price (see step no. 4 in the screenshot below). Accordingly, the “Market” order is particularly suitable for beginners and investors who want to sell or buy quickly. Since you want to sell your Bitcoins and get ETC for them, you have to use the left field “Buy ETC”. In the line “Amount” you enter how much ETC you want to buy. Once you have entered everything, you can click on “Buy ETC”.

Under normal circumstances, the ETC coins will be credited to your Binance Wallet within a few seconds. As with Litebit, we recommend transferring the Ethereum Classic to an external wallet. A corresponding instruction for a free Wallet we present to you in the following.

>> Buy and sell Ethereum Classic on Binance now*<<

Best free Ethereum Classic Wallet

If you want the best possible protection for your cryptocurrencies, you should buy a hardware wallet. Have a look at our hardware wallet comparison. Our test winner is the Ledger Nano X hardware wallet. However, if you don’t want to spend money, we recommend the free Atomic Software Wallet for Ethereum Classic. The Atomic Wallet is a Multi-Coin-Wallet with which we have had very good experiences in the past two years and which can manage over 300 additional cryptocurrencies.

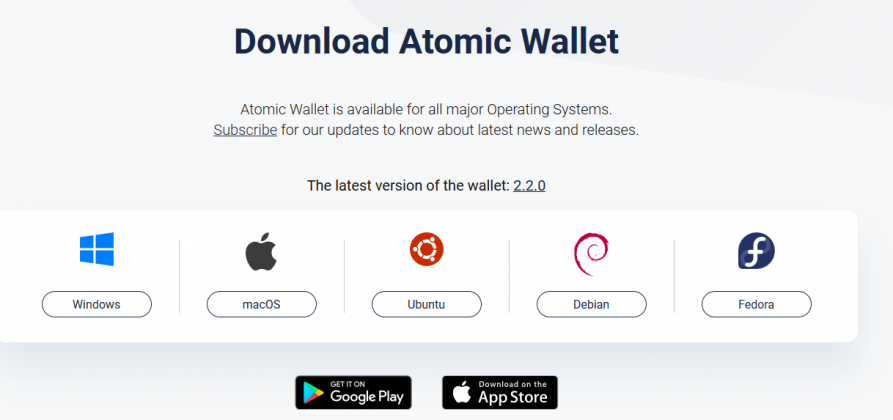

To install it, you must first go to the official website and download the software. Click on the following link, which will take you directly to the download page. The Wallet is available as desktop version for Windows, Mac, Ubuntu, Debian and Fedora. There is also a mobile version for iOS and Android in the respective App Store

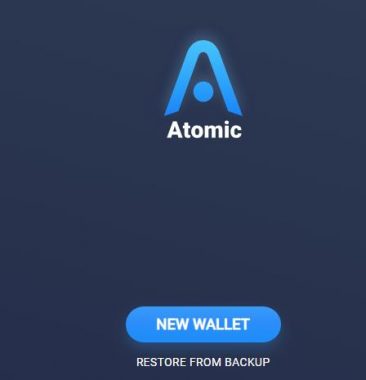

Depending on which operating system you are using, you can download the appropriate version. The download should not take very long (with a file size of 100 MB). When the download is completed successfully, you will need to install the software. First you will be asked if you want to create a new wallet or restore an old one. Now click on “New Wallet” so that you can create a new wallet.

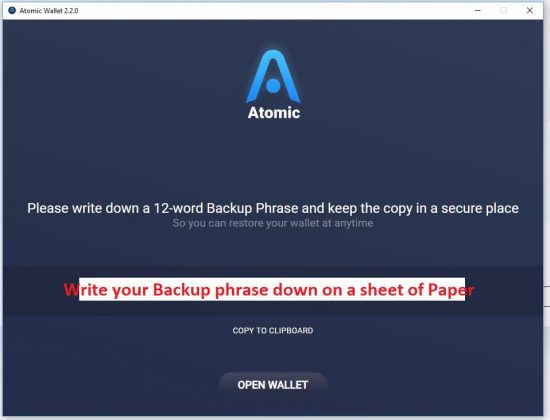

Then you have to enter your password and confirm it again. The wallet will then be created for you. This is the most important step of the installation. The Atomic Wallet will now display your backup phrase. Write these 12 words on a sheet of paper. You must keep this in a safe place.

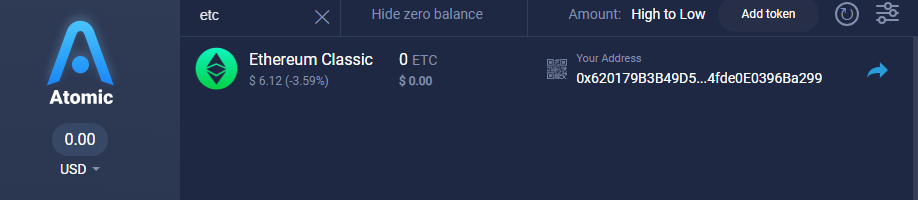

With the help of this phrase you can restore your account in case your PC or laptop breaks down. When you have successfully written down your seed, click on “Open Wallet“. The Wallet’s dashboard shows you numerous cryptocurrencies. Therefore click in the upper left corner of the search field and enter “ETC”. You will now see Ethereum Classic. In the line behind it you already see your “Reveive Address”:

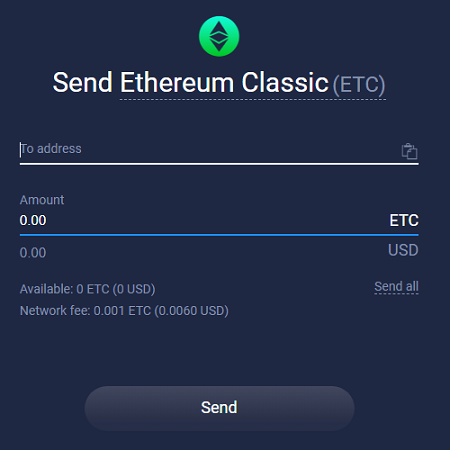

You must insert your Receive Address as the receiving address at Litebit, Coinbase, Binance or any other exchange. Your ETC will then be sent to this address. If you want to send ETC from your Atomic Wallet to another exchange or wallet, click on Ethereum Classic. You will then receive the following overview where you can enter the destination address:

You can check the current Ethereum Classic course either in our Ethereum Classic Chart or in our course overview, which includes prices from over 2,000 altcoins.

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.

If you liked our guide, please rate our guide:

[ratings]If you have any questions, please feel free to leave us a comment. We’ll be glad to help you!