In this article we will introduce the Global.TradeATF online trading platform and examine whether the broker is a trustworthy and more secure alternative to other brokers, such as eToro or Plus500. The focus will be on whether Global.TradeATF is a reputable provider of CFDs on cryptocurrencies where you can trade without worries.

About Global.TradeATF

Global.TradeATF is a CFD broker that specializes in CFDs: forex pairs, stocks, indices, commodities and also cryptocurrencies, with a wide selection compared to other brokers. Global.TradeATF is a subsidiary of Bayline Trading Ltd, a company based in Belice and therefore subject to the strict supervision of and regulated under IFSC 60/322/TS/19. Although the CFD broker is still relatively young – it was only founded in 2019 – the platform already has over 10,000 active users.

Global.TradeATF offers both a demo account and of course a real money account. Real money trading is possible with a minimum deposit of 250 USD or the equivalent in another currency. A great advantage is futhermore that the Global.TradeATF website is available in English, Portuguese, Dutch, French, German, Italian, Latvian, Russian, Spanish and Swedish.

A total of six asset classes are available with over 250 different CFDs:

- Over 30 cryptocurrencies

- Indexes

- Metals

- Commodities

- Foreign exchange

- Shares

** Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Most important information

✅ Website: www.TradeATF.com

✅ Leverage: up to 1:30 (for private customers)

✅ Minimum deposit: 250 USD or EUR or GBP

✅ Demo account: Yes

✅ Deposit and withdrawal methods: credit and debit cards (Visa, Mastercard, Maestro), Skrill, Neteller, V-Pay

Available CFDs on cryptocurrencies

Global.TradeATF offers a total of 9 different cryptocurrencies that can be traded either against the US dollar (USD), euro (EUR) or the British pound (GBP). You should be aware, however, that Global.TradeATF only offers CFDs on cryptocurrencies and no “real” Bitcoin. However, this has clear advantages.

CFDs do not require traders to own the cryptocurrency themselves in order to benefit from volatility. As a result, you don’t have to worry about keeping Bitcoin, Ethereum or other Altcoins in a wallet. This also makes your investment much less susceptible to hacks. Below you will find the list of available trading pairs:

- Bitcoin vs. Euro (Bitfinex)

- Bitcoin vs Great Britian Pound (Bitfinex)

- Bitcoin vs. US Dollar (Bitfinex)

- Bitcoin Gold vs. US Dollar (Bitfinex)

- Dash vs. Euro (Bitfinex)

- Dash vs Great Britian Pound (Bitfinex)

- Dash vs. US Dollar (Bitfinex)

- Ethereum Classic vs. Euro (Bitfinex)

- Ethereum Classic Great Britian Pound (Bitfinex)

- Ethereum Classic vs. US Dollar (Bitfinex)

- Ethereum vs. Euro (Bitfinex)

- Ethereum vs Great Britian Pound (Bitfinex)

- Ethereum vs. US Dollar (Bitfinex)

- Litecoin vs. Euro (Bitfinex)

- Litecoin vs. Great Britian Pound (Bitfinex)

- Litecoin vs. US Dollar (Bitfinex)

- Stellar Vs. US Dollar (Bitfinex)

- Monero vs. US Dollar (Bitfinex)

- Ripple vs. Euro (Bitfinex)

- Ripple vs Great Britian Pound (Bitfinex)

- Ripple vs. US Dollar (Bitfinex)

It is important to know that CFDs on cryptocurrencies can only be traded with a leverage of 1:2 due to the regulations of the European Securities and Markets Authority, in short: ESMA, which apply to all brokers offering their services within the European Union. This applies to the Silver account as well as both other account types.

Is Global.TradeATF secure and trustworthy?

In the view of the Commission, the answer to this question is clearly ‘yes’. Because Global.TradeATF is based in belice and thus the broker is subject to very strict regulations. Global.TradeATF is under the supervision of IFSC (licence number 60/322/TS/19), which ensures that the broker complies with high standards. These standards also include, for example, investor protection of up to 20,000 EUR. In addition, Global.TradeATF is therefore also obliged to store its business assets separately from user deposits.

In addition, Global.TradeATF provides security for transactions by using SSL encryption for data transmission. Furthermore, the broker also has a comprehensive customer service and a large info and tutorial section with content in the form of text, images and videos. The customer service is available from Monday to Friday from 7am to 5pm GMT.

Account Types

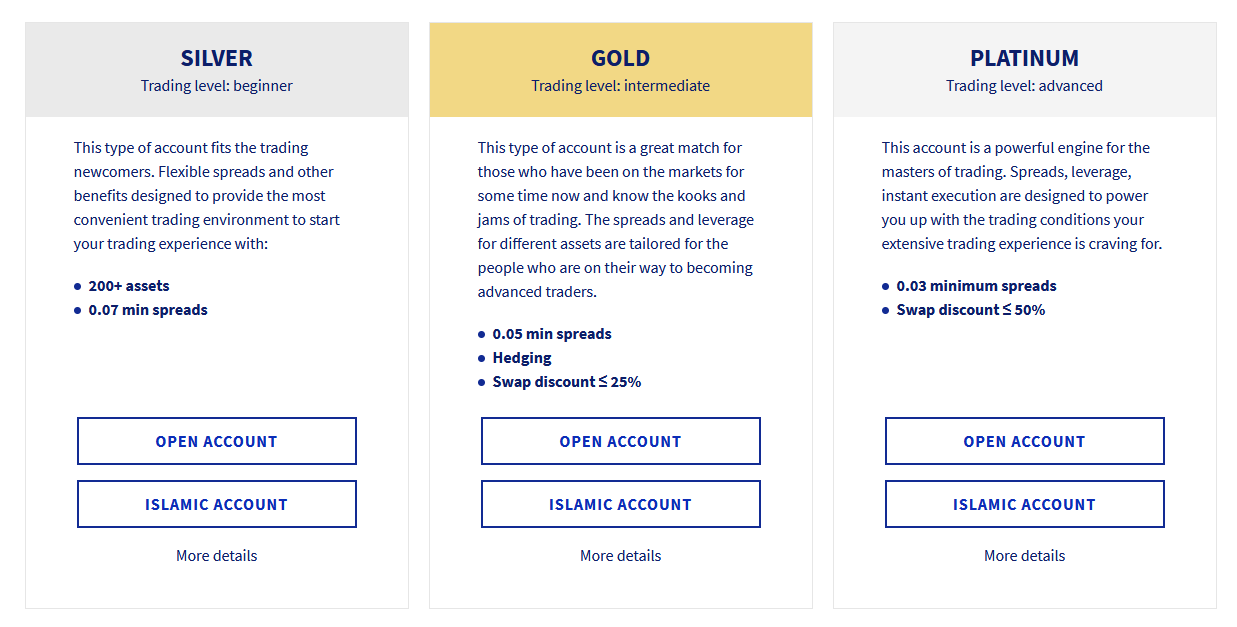

Global.TradeATF offers three different account types: Silver, Gold and Platinum.

Silver

It is important to know that there is no restriction on what CFDs can be traded. With a Silver Account you can access all CFDs, as well as Gold and Platinum accounts. However, there is a significant difference in terms of leverage. Due to ESMA regulations, “simple investors” who do not have a professional background are only allowed to trade with a leverage of maximum 30x. The minimum spread is a minimum of 0.07.

Gold

The Gold account is designed for experienced traders with a professional background in trading who want more than what the Silver level has to offer. The minimum spread is much lower at 0.05. Gold customers also have the option of trading with 400 times leverage. There is also a 25% discount on the swap fees.

Platinum

The Platinum Account is designed for traders with higher investments and the professional market. The minimum spread is only 0.3, the maximum leverage is 500x, and all analysis and trading tools are unlocked for optimal trading. The discount on the swap fee is 50%.

The following overview also provides a further summary of the advantages of the individual types:

Trading platforms

WebTrader

The WebTrader platform is accessed via a browser and offers full access to all Global.TradeATF features. The advantage is clearly that you don’t need any additional installation, additional software or other downloads. One of the most important functions of WebTrader is the synchronization with the Metaquotes software, which eliminates the risk of delays and non-transferred trades.

Furthermore, the WebTrader offers full MT4 functionality, so that nine time frames of long and short term investment strategies can be set on the trading platform. Of course, the WebTrader also includes analytical tools for a thorough technical analysis.

MetaTrader 4

Like many other brokers Global.TradeATF supports the popular client MetaTrader 4 (MT4). MT4 has gained a good reputation over the years and offers a wide range of features. There is both a desktop version and a mobile application. The popular platform can not only be used to execute trades, but can also be used for analysis and automated trading. MT4 can be downloaded to any computer.

Mobile app

Global.TradeATF’s mobile app is available for iOS and Android based devices and is powered by the technology engine of MetaTrader 4. Just like the web version of the MT4 platform, the app allows you to synchronize accounts, place trades and execute all types of orders, including Stop Loss and Take Profit. So you can use your smartphone or tablet, and have full access to all functions as well.

The Global.TradeATF platform in check

Fees

In principle, there are initially no fees for the deposit or withdrawal of funds. However, it is important to note that payment service providers may charge fees. In addition, the broker also charges spreads, which change are floating.

There is also a so-called swap fee that you have to pay if you leave a position open overnight. Swap fees can be both positive and negative. The amount depends on the CFD being traded and varies from account type to account type.

Traders should also be aware of the inactivity fee that must be paid if an account is not used for over a month. The fee is €80 per month, but is only charged on day 61 of inactivity, but then retroactively (€180).

Deposits and withdrawals

Deposits in Dollars, Pounds or Euros can be made through the following channels, which will also be used to request withdrawal

Opening an account with Global.TradeATF

The process of opening an account is really very intuitive and simple and can be done in a few steps. As the most reputable broker, Global.TradeATF has to perform a KYC (“Know your customer”) procedure, where you confirm your identity by means of a photo ID and your address by means of an invoice (e.g. for energy, telephone, etc.) You will need to upload the individual documents so Global.TradeATF can verify them. After these documents have been verified, you can make your first deposit (at least 250 EUR), which will unlock additional features. Now you can start trading!

Important: If you have not had much experience in trading, you can also use the demo account first to familiarize yourself with the functions and brokerage. This is available after the registration process.

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.

Conclusion

The Global.TradeATF adheres to the strict regulatory guidelines of the IFSC and is therefore classified as a very serious broker. With 250 different CFDs the broker offers an interesting amount of tradable assets. Crypto traders can trade their favorite currencies against USD, EUR and GBP.

** Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.