In this article we introduce the online trading platform ETFinance and examine whether the broker is a trustworthy and safe alternative to other brokers such as eToro or Plus500. In particular, we try to answer the question whether ETFinance is a reputable provider for CFDs on cryptocurrencies.

About ETFinance

ETFinance is an online broker based in Cyprus and is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC). The broker is therefore subject to very strict supervision, which is one of the most important financial market supervisory authorities in Europe, as many well-known brokers are also based in Cyprus.

It is important to know that ETFinance is a CFD broker. CFDs are so-called derivatives whose value or performance depends on the development of one or more underlying assets. They are therefore specialised financial products that allow traders to open positions in a variety of financial markets in a simple manner. The underlying asset is not acquired. You will receive a certificate on it. The advantage of this is that you can trade financial products such as stocks, indices, precious metals and even cryptocurrencies with leverage to achieve higher profits.

For newcomers it is very pleasant that the platform provides a large training area. This includes webinars, a glossary, ebooks, courses, video tutorials and many other useful features. With the available demo account you can also enter the world of trading in a two-week test phase and get a feeling for the platform and trading CFDs with virtual money.

Key facts

✅ Website address: https://www.etfinance.eu

✅ CFDs: cryptocurrencies as well as foreign exchange, stocks, indices, commodities, ETFs

✅ Leverage: up to 1:30 (for private customers)

✅ Minimum deposit: $250/€215/£200

✅ Demo account: Yes, 14 days

✅ Deposit and withdrawal methods: credit and debit cards (Visa, Mastercard, Maestro), Skrill, Neteller

**Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Is ETFinance trustworthy and secure?

We can confidently answer this question with yes. As mentioned in the introduction to ETFinance, the broker is controlled and regulated by the Cypriot Financial Market Authority, the CySEC licence. As a result, the platform is subject to a very strict set of rules. Among other things, ETFinance must have a working capital of at least EUR 730,000, manage customer funds in a separate escrow account separate from working capital, provide negative balance protection and submit regular reports to allow for external audits.

In addition, ETFinance is part of an investor compensation fund that guarantees users’ deposits up to a value of EUR 20,000, even in the unlikely event that the broker files for bankruptcy. The broker also offers a range of features for inexperienced and professional traders, including a great training centre, a wide range of tradable assets, solid customer support and advanced trading tools.

Account types on ETFinance

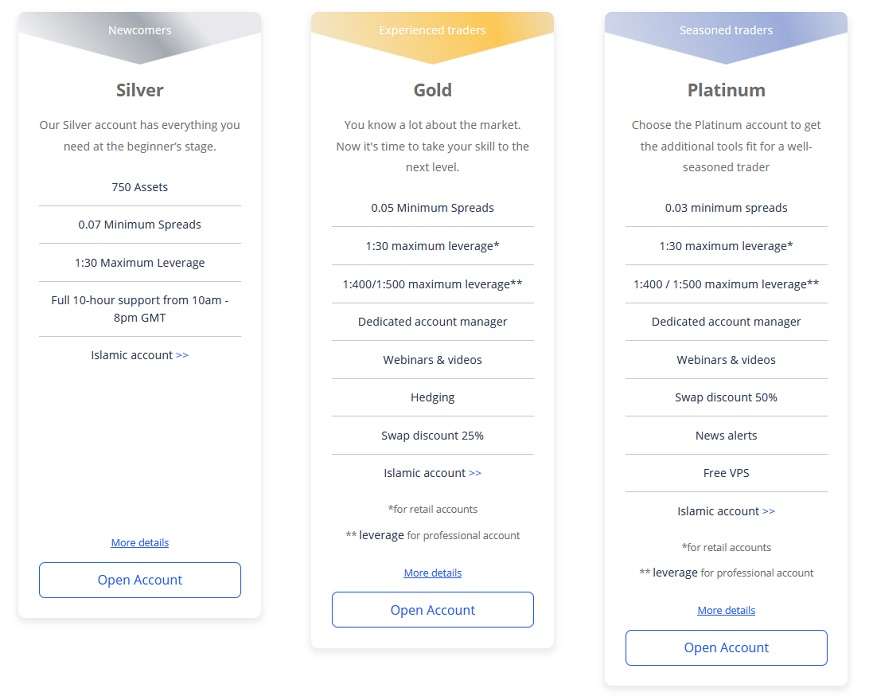

On ETFinance you can choose between three different account types. These differ on the one hand in terms of the requirements you have to meet in order to receive this type of account. On the other hand, higher levels offer a lower spread and significantly higher leverage.

- Silver: The basic account that everyone receives is the Silver account. With this account you can basically access all functions of the platform. However, the following limits apply: 750 different assets, the minimum spread is 0.07 and the maximum leverage is 1:30. However, you can also use the very good customer service for 10 hours a day.

- Gold: The Gold Account is designed for experienced traders. Clients in this category can benefit from low spreads (starting at 0.05), have a maximum leverage of 1:400 / 1:500 (if on a professional account) to choose from and have a personal account manager.

- Platinum: The Platinum status grants customers of the platform a minimum spread of 0.03, a maximum leverage of 1:400 / 1:500 (if on professional account) and an additional exchange discount of 50%.

To be eligible for all the benefits of a professional account, you must meet two of the following three criteria:

- Trading volume: You must have opened at least 10 trades with a leveraged trading size of €3,000 or more on cryptocurrencies/shares or over €12,500 investments in forex/commodities in the last three months.

- Market Experience: You must have at least one year of professional experience in a financial industry activity, especially with leveraged products or CFDs.

- Financial Status: You must have a net worth and/or trading portfolio worth €500,000 or more, including cash deposits and financial instruments.

**Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Platforms for trading on ETFinance

Webtrader

The WebTrader is a web-based platform that provides access to the global financial markets of ETFinance via any device with just an Internet connection and a web browser. It offers all the possibilities offered by ETFinance. With the WebTrader you can monitor various assets and trends, perform technical analysis and trade with just a few clicks. On the user interface you can set different trading strategies and enter entry and exit points.

MetaTrader 4

MetaTrader 4, also known as MT4, is an industry standard trading platform. It is a software that must be downloaded and installed. You can then trade on ETFinance from your desktop PC or laptop. It is undoubtedly the most popular trading platform on the market, preferred by both professional traders and beginners, and was developed by MetaQuotes Software and released in 2005. It also offers over 50 editable market indicators and trading robots that make automated trading sessions easy to perform.

Mobile app

The mobile app from ETFinance is available for iOS and Android devices and is designed to make trading quick and easy. The app provides full access to the same features as the web platform, but is also designed in a user-friendly format for smartphones and has a responsive user interface.

Available CFDs on Cryptocurrencies

On ETFinance you can trade 20 different cryptocurrencies, which can be traded either against the US dollar (USD), Euro (EUR) or the British pound (GBP). It is important to note that ETFinance only offers CFDs on cryptocurrencies and no "real" Bitcoin. What may initially appear to be a disadvantage can also be an advantage

With CFDs you do not need to own the cryptocurrencies yourself. So you don't have to worry about keeping your Bitcoin, Ethereum or other Altcoins in a wallet. Instead, your investment is kept in your account with ETFinance, which is less vulnerable to hacks. Below you will find the list of available cryptocurrencies:

- Bitcoin

- Litecoin

- Bitcoin Cash

- Dash

- Ethereum

- Ethereum Classic

- Ripple

- Zcash

- Bitcoin Gold

- Monero

- Verge

- Siacoin

- Cardano

- IOTA

- NEO

- Tether

- Stellar

- NEM

- Qtum

- Lisk

Due to legal regulations, you cannot trade cryptocurrencies with a leverage of 1:30, as is usually the case with the Silver account. CFDs on cryptocurrencies are limited to a leverage of 1:2 due to the regulations of the European Securities and Markets Authority, ESMA for short. This restriction applies to the basic account as well as to professional traders.

**Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Trade crypto CFDs on ETFinance

Fees

The fees on ETFinance are in the middle range. This means the broker has competitive spreads and does not charge commission fees, regardless of the type of account you choose or the asset you trade. As described above, the spreads differ according to the type of account, but also according to the asset you trade.

It is pleasing to note that ETFinance does not charge any fees on inpayments. The minimum deposit is 250 USD/ 215 EUR/ 200 GBP, which means that even beginners can test the platform with real money using relatively little money. However, it is important to know that the broker reserves the right to charge a fee of €50 if you withdraw after only one trade or if you have not traded at all. You should be aware of this right at the beginning.

As with other brokers, there is an inactivity fee that is charged if you are inactive for more than 60 days. This fee starts at 80 EUR in the first month and increases thereafter to 200 EUR if you are inactive for more than 181 days.

Payment methods

ETFinance offers its customers various simple and secure payment methods. For example, ETFinance enables its customers to pay via various banking options:

- Bank transfer

- Credit cards like MasterCard, VISA, Maestro

- Neteller

- Skrill

It's that simple: The single steps for trading crypto CFDs

To trade cryptocurrencies on ETFinance, you need to create an account and verify it. In detail, you have to follow these steps:

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.

- Create an account: Visit the ETFinance website and click on "Open account" to display the registration form. This has several pages where you have to enter all the necessary personal, account and financial information. You will also need to verify your details by uploading a proof of identity (e.g. ID card) and an invoice to verify your address.

- Depositing funds into your ETFinance account: Click on "Deposit funds" and select the most convenient payment method for you from those listed above.

- Choose a trading platform: WebTrader, MetaTrader4 or mobile app.

- Start your first trade on ETFinance!

Conclusion

ETFinance is a reliable broker licensed and approved by the Cyprus Securities and Exchange Commission (CySEC). ETFinance also offers negative balance protection and an investor protection fund. These facts make ETFinance a reputable broker. The integration with MetaTrader4 is also worthy of mention. The platform is well known and highly regarded in the trading world and has already received awards in the past. However, the other platforms of ETFinance also offer a simple and clear user interface.

**Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.