Meanwhile, there is an almost infinite number of ways to purchase, buy, trade and invest in Bitcoin. While some require a greater technical understanding, other alternatives are quite easy to use even for newcomers to the Bitcoin market. The latter undoubtedly include the broker eToro, which provides a platform where anyone, from beginner to advanced trader, can buy and trade BTC.

On eToro customers can buy and sell BTC and enjoy benefits not available on other exchanges, such as instant execution of market orders. Furthermore, using eToro does not require the use of your own digital wallet.

eToro: Buy Bitcoin – In three easy steps

If you’re in a hurry and just need a quick step-by-step guide on how to buy Bitcoin on eToro, you’re headed here. Here’s how buying BTC from the broker eToro works in three steps.

**68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.

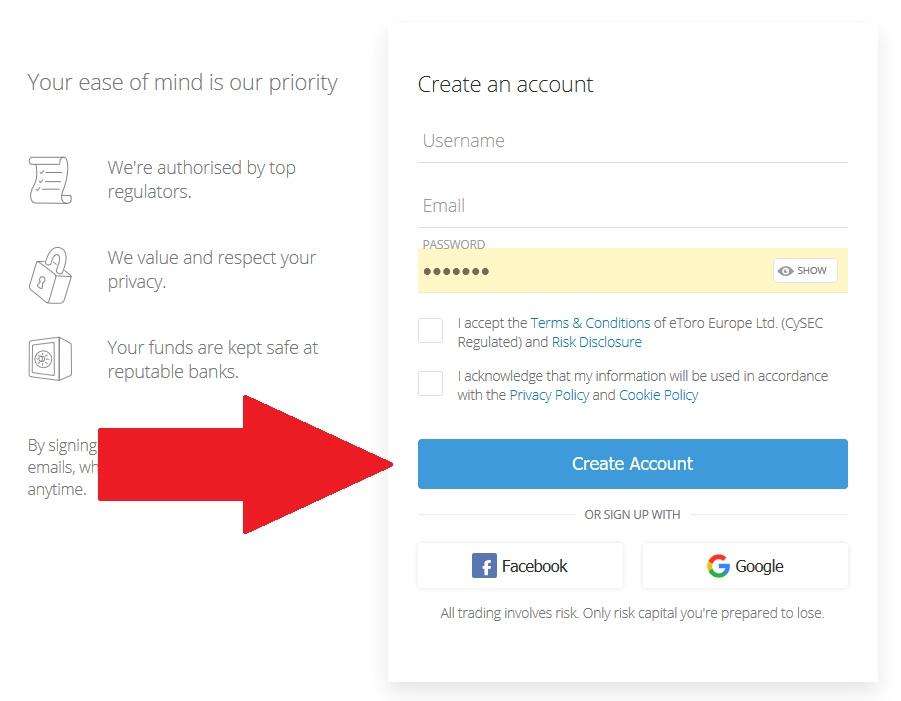

Step 1: Register with eToro

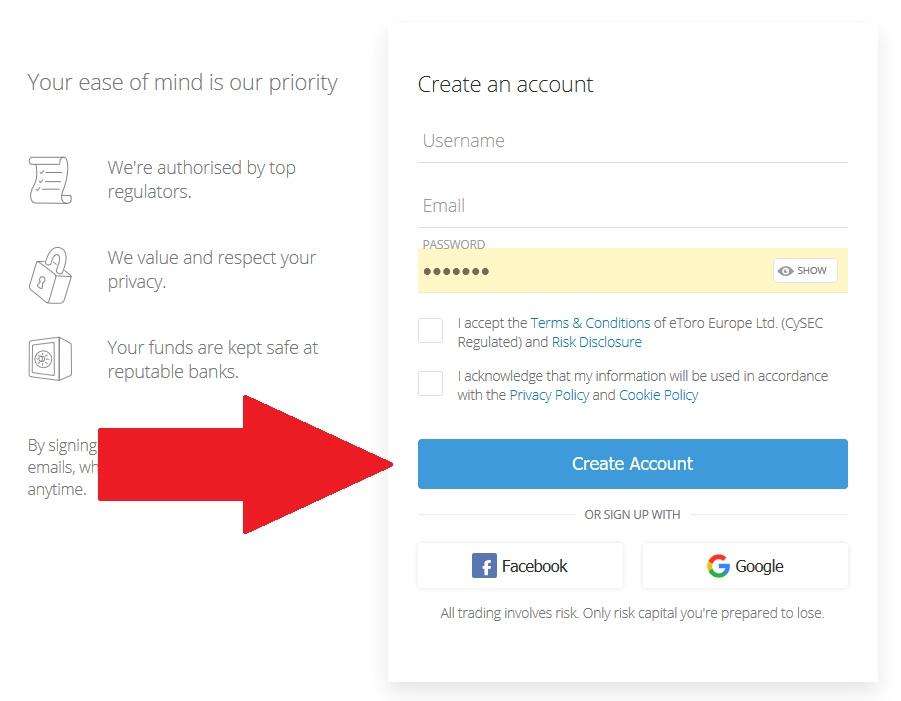

The first step is to create an account with eToro. Simply go to the website* (using the button above) and click the green “sign up now” button. A new window will open asking you to enter a username, email address and password. Once you have entered all the information, you must also accept the Terms of Use and Risk Disclosure, Privacy and Cookie Policy. Then you can click on the blue button “Create account”. You will then receive a confirmation link in your email to activate your account.

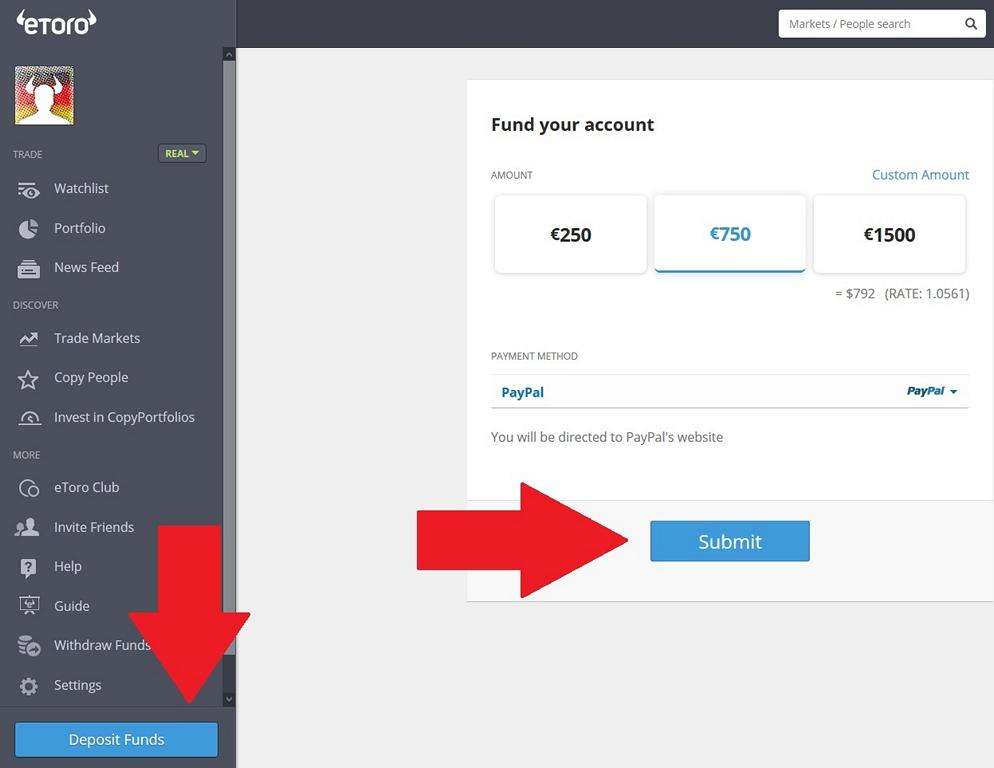

Step 2: Deposit money

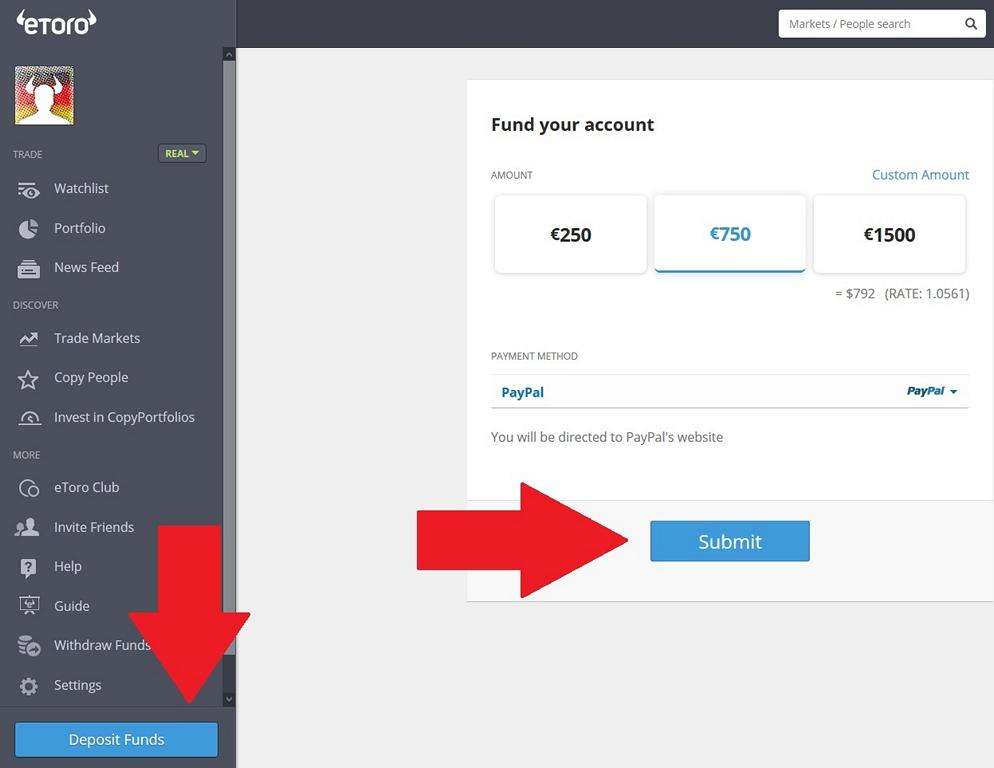

In the next step you can deposit money directly. To do this, simply click on the button “Deposit money”. You have to keep in mind that eToro only allows deposits up to 2,000 dollars without full verification. So you may need to register and verify your personal details first (see the detailed instructions for more information).

To buy Bitcoin on eToro you can continue without verification. After clicking on “Deposit money” a new window will open on the right side as you can see in the picture below. Here you enter the amount you want to deposit and the payment method.

Probably the fastest and easiest payment method in our experience is PayPal (if you have an account). Otherwise, the following payment methods are available:

- Credit card

- PayPal

- Instant Bank Transfer

- Rapid Transfer

- Skrill

- Bank transfer (SEPA)

- Neteller

- UnionPay

Simply select your preferred payment method from the drop-down menu and click the “Send” button. If you’re in a hurry and want your deposit to be instantly visible on your eToro account so you can start buying Bitcoin right away, we recommend you deposit by credit card, PayPal or Skrill. Your funds will be instantly available on your trading account.

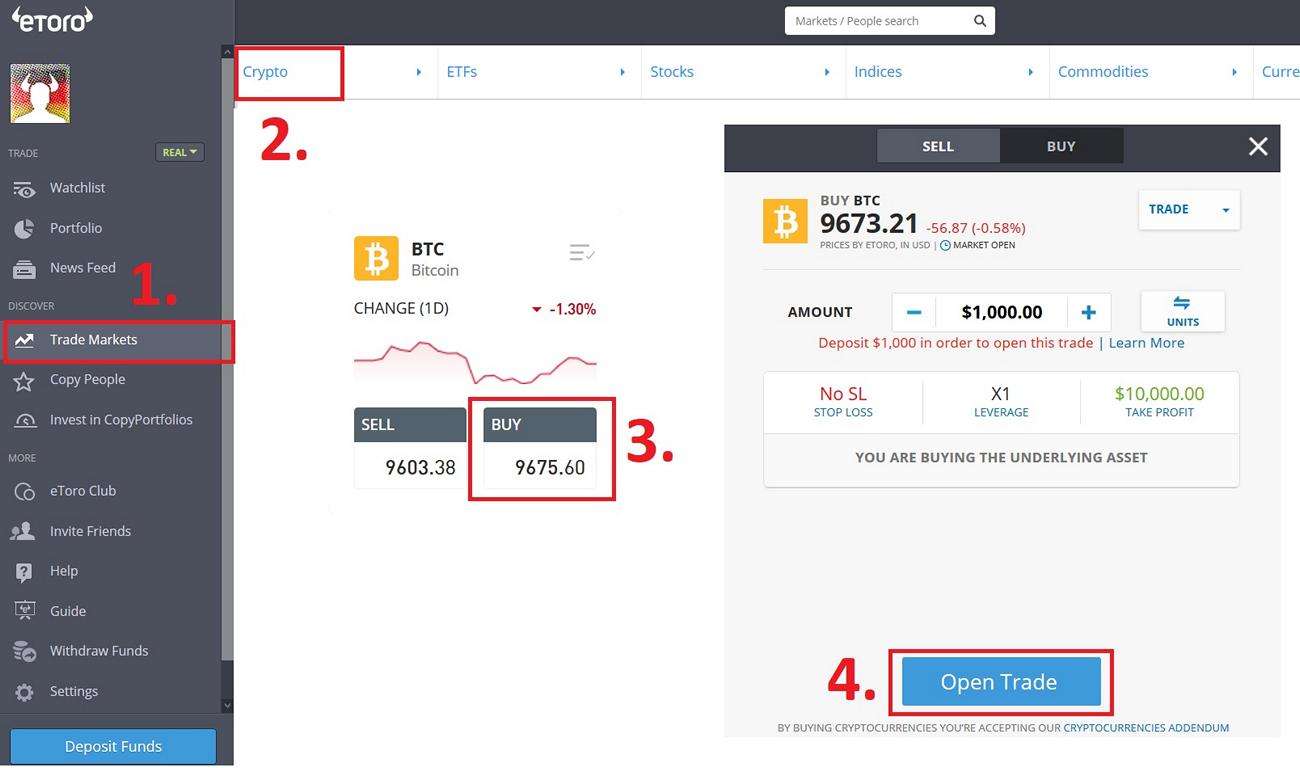

Step 3: Buy Bitcoin on eToro

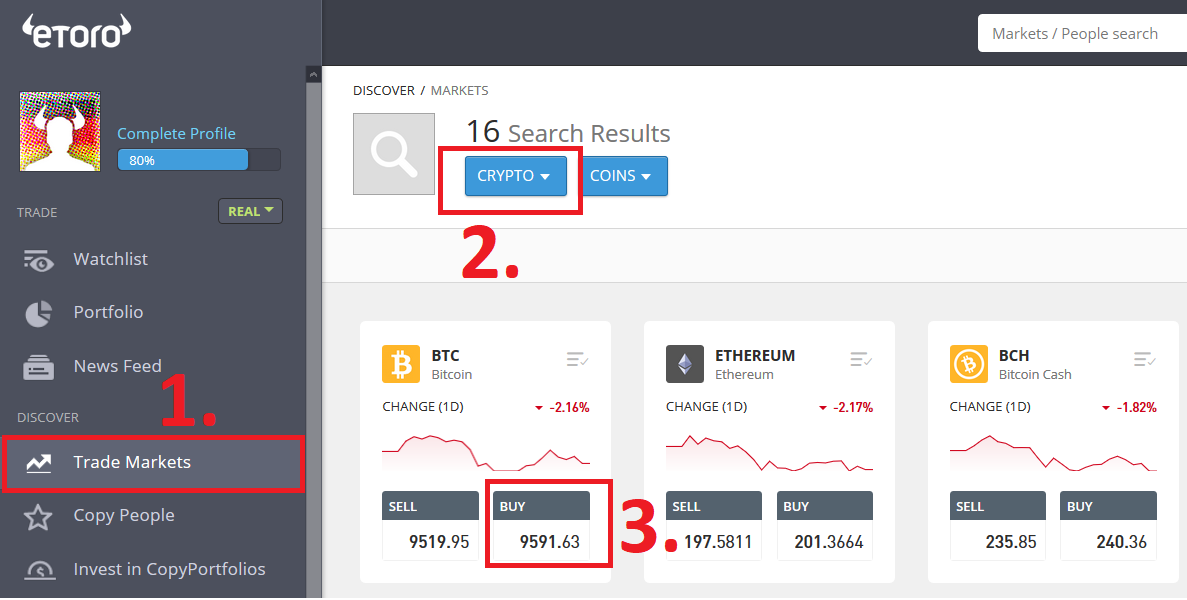

Once the deposited money appears in your account you can start buying Bitcoin on eToro. Simply go to the menu item “Markets” and then “Crypto”. Both steps are shown in the screenshot below.

A new window opens in the right side where you can find the options to Buy and Sell Bitcoin (step 3 in the screenshot). Now you can click on the “Buy” button. A new pop-up window will open. You can leave all settings as default if you just want to buy “real” Bitcoin and not CFD’s. Except for your desired amount, there is no need to make any other changes. If you click on “Open trade” (step 4), the Bitcoins will be bought immediately and will appear in your eToro Bitcoin account.

If this short manual is not detailed enough for you or if you have open questions about individual functions, we recommend that you read our explanations in the following section carefully. We explicitly discuss individual functions and explain why verification is important for eToro in the long run.

Buy Bitcoin on eToro – Step by step guide

If you’ve already signed up and made a deposit, you can skip the following part and scroll directly to the information about eToro’s fees, costs and special features. Whether you want to set up a demo or real money account to trade Bitcoin, you first need to create an account with eToro.

**68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.

How does registering with eToro work in detail?

The first step in setting up an account with eToro is to visit the official website etoro.com. The best way is to click on the button above. Now click on the green “Sign up now” button on the homepage. A new window will open where you have to enter your username, an email address you want to verify and a password.

Once you have entered all the information, you must also accept the Terms of Use and Risk Disclosure, Privacy and Cookie Policy. Then you can click on the blue button “Create account”. You will then receive a confirmation link to your email to activate your account. After you have done this, your account is ready to go.

Verification on eToro

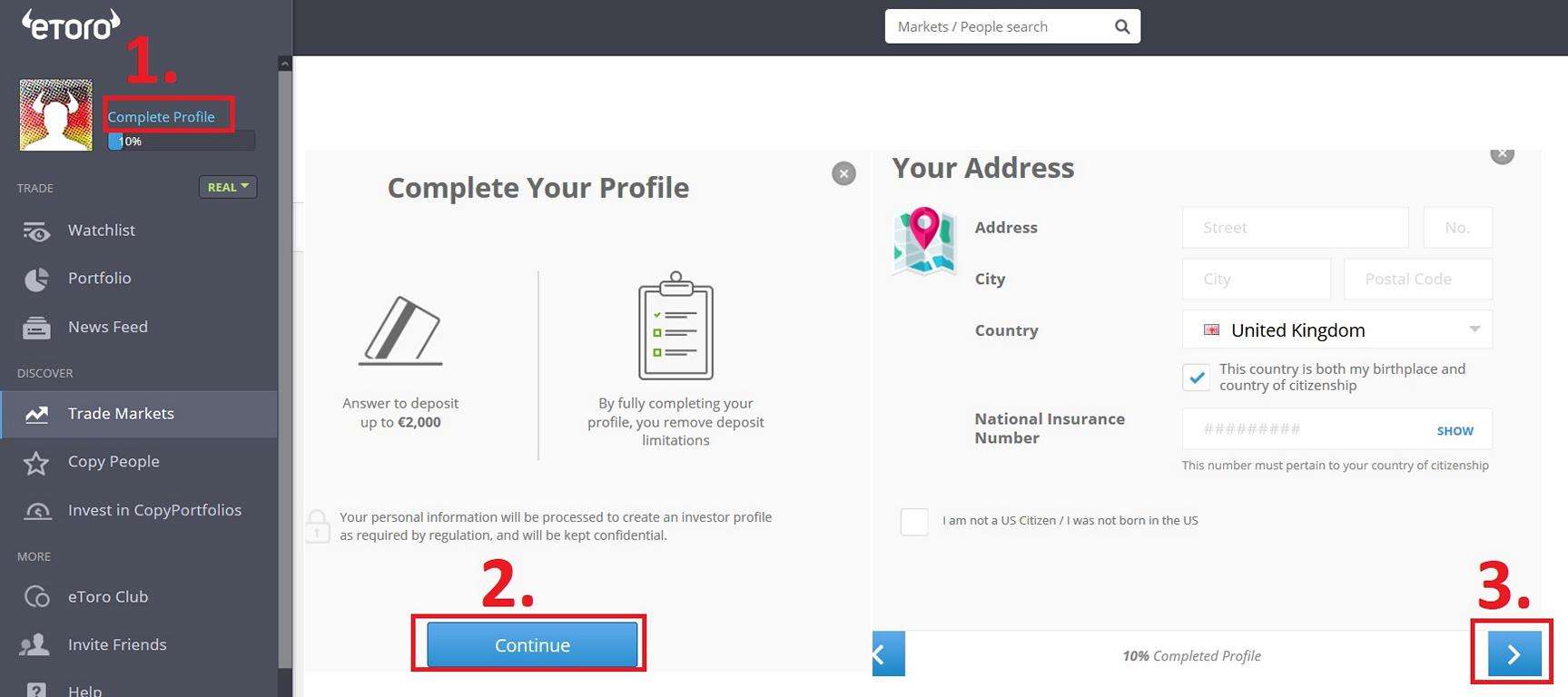

After clicking on the verification link in the email you will be automatically logged into your account. You may have to update the website again. Your current account is subject to certain deposit limits as you have not yet verified your identity. Therefore, a deposit limit of 2,000 euros or dollars applies for the time being.

In order to buy larger amounts and make withdrawals you need to prove your identity and address as well as a tax number. There is no way around verification, so we recommend you do it immediately after registration.

This process is required by the strict requirements of EU law and other laws worldwide and is already a standard procedure on many other exchanges. The verification is completely free and can be done in a few simple steps. Click on the “Edit” button next to your name (see screenshot).

Afterwards a new pop-up window “Create your profile” will open. At this point you can simply click on “Continue”. eToro will ask you 10 questions. Among other things you have to enter your full name, your address and your date of birth. Additionally eToro asks you about your trading experience. At this point don’t be intimidated by the questions and answer them honestly. Your information will not affect your successful verification.

eToro also checks your phone number and sends you a verification code via SMS which you have to enter on the website. In step 8 of 10 you need to upload either your ID card or passport. You can easily take a photo with your smartphone.

In the last step you have to verify your address by uploading for example a current electricity bill or another document.

Deposit Euro or dollars to buy Bitcoin

Now you can deposit money. All you have to do is select “Deposit money” in the lower left corner and then enter your preferred payment method. Depending on the method of deposit, the deposit will faster or slower.

eToro offers the possibility to open the trading account with a minimum deposit of only 200 USD. All further deposits, except the first deposit, must be at least 50 USD. Another exception are deposits via bank transfer where the minimum deposit is 500 USD.

Buy Bitcoin with PayPal

PayPal is probably the most popular payment method to make a deposit at eToro. The big advantage of PayPal is that the amount you deposit is immediately available for Bitcoin trading on your account.

Buy Bitcoin with credit card

If you have a credit card, you can also buy Bitcoin by credit card. As with PayPal, your deposited money is immediately available on your eToro trading account.

Buy Bitcoin with bank transfer / SEPA

If you have neither an electronic payment method (such as PayPal) nor a credit card, the classic bank transfer (SEPA) is probably the best solution for you. However, keep in mind that the minimum deposit is USD 500. If you choose bank transfer you will see eToro’s IBAN and BIC so you only need to make one transfer from your bank account. Another drawback: The money will arrive on your eToro trading account after 1-2 days.

**68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.

Tutorial to buy Bitcoin on eToro

eToro has the special feature that both “real” cryptocurrencies can be bought on the platform, as well as Bitcoin CFDs. Crypto CFDs are not available to US users and under FCA. CFD stands for Contract for Difference.

You need to remember the following for trading on eToro: All buy positions without leverage for cryptocurrencies (since September 3, 2017) are traded as a real asset. Your investment on eToro is secured with the real asset. This means that eToro buys the cryptocurrency in your name and stores it in a separate account under your name.

All leveraged buy positions are executed as CFDs. CFDs are so-called derivatives – a security whose value or performance depends on the development of one or more underlying assets. They are specialized and popular over-the-counter (OTC) financial products that allow traders to easily open positions in a variety of financial markets. The underlying asset – the cryptocurrency – is actually not purchased by the investor, only a certificate on it.

Buy “real” Bitcoin from eToro

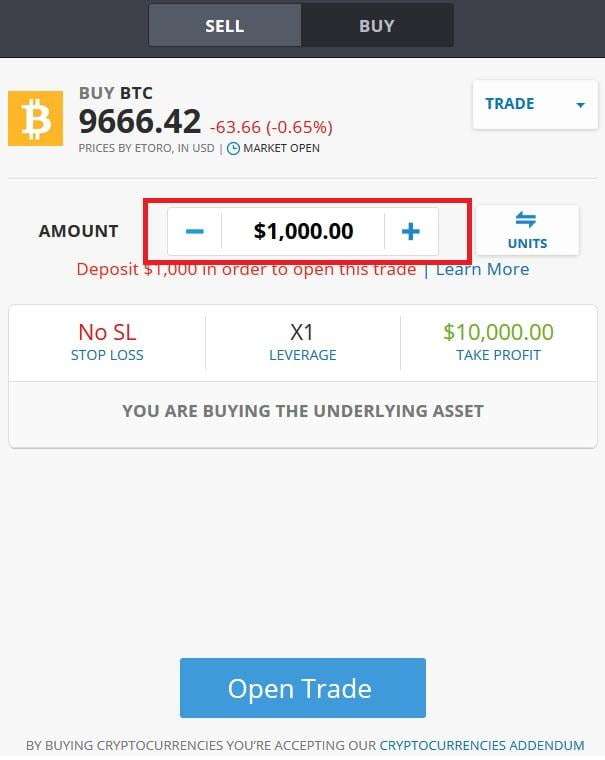

To buy not only a CFD, but the cryptocurrency, you must first click on “Markets” in your account and then on “Crypto“. After that a new window will open on the right side where you have to select “Buy” Bitcoin (step 3, see screenshot).

Afterwards a new pop-up window will open. In this pop-up window, you should not change any other settings except to enter your amount if you want to buy “real” Bitcoin. As soon as you click “Open Trade”, the order will be placed. Your transaction will be executed within a few seconds.

On “Portfolio” you will see your Bitcoin balance and have the option to buy or sell more, as well as to view the price development.

**68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.

Buy Bitcoin CFDs

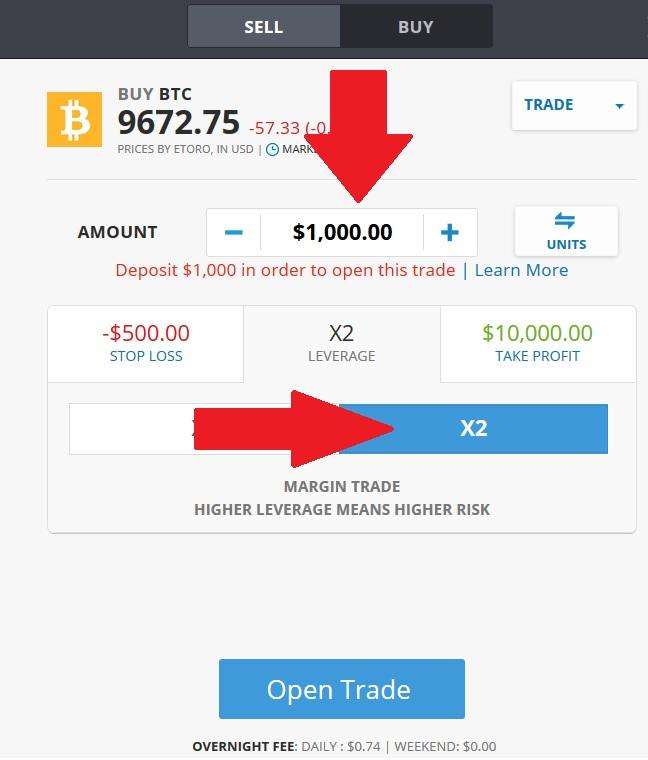

Buying Bitcoin CFDs works very similarly and almost analogously to the previously presented buying guide for buying real Bitcoins. However, some parameters have to be adjusted in the pop-up window.

First you determine, as usual, the amount of money you want to invest in this trade. Then you have to set the leverage multiplier “X2”. For cryptocurrencies eToro does not currently offer a larger leverage. After that you should set your stop loss and take profit settings (more on that later). A stop-loss limit is very important to limit the potential risk. Then you can open the trade.

Stop Loss means that the trade is automatically closed if the Bitcoin price reaches a specified market price or money amount. Your money will then be transferred back to your account. Take Profit determines when your trade will automatically close when the profit on your trade reaches the amount you choose. For both Stop Loss and Take Profit, you should consider carefully what values you set

It’s also important to know that there are overnight fees (also called rollover fees) with eToro. These appear in the pop-up window before you place your order.

**68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.

Why should you buy Bitcoin on eToro?

In recent years eToro has become increasingly popular in Europe other parts of the world. Within a very short time eToro has become one of the leading brokers. The company, officially based in Cyprus (EU), specializes in trading in foreign exchange, stocks, indices, ETFs and certificates on commodities. However, since 2017 eToro has added more and more cryptocurrencies to its portfolio and currently offers 16 different cryptocurrencies for trading – as real cryptocurrency and as CFD.

The company was founded in Cyprus in 2007. It is therefore subject to the Cyprus Securities and Exchange Commission (CySEC). In addition, eToro has established a subsidiary in the UK, which is why it is also controlled by the British FCA.

The increasing popularity of eToro is not only due to its high seriousness but also to the numerous features it offers. Especially in the area of social trading and copy trading the broker clearly stands out from the competition (as we’ll explain in detail later).

eToro fees and costs

The fees can be found very easily and quickly in the general information on eToro. This is very commendable from our point of view. As of 2019-06-19 eToro charges the following fees for cryptocurrencies:

It should be noted that the fees listed above apply only to leveraged buy positions, as well as to all sell positions and to all crypto-pair positions (but not to the purchase of “real” cryptocurrencies without leverage).

Furthermore, a processing fee is charged for the payouts. You will see the respective withdrawal fee in the cashier area after you have entered the withdrawal amount. For withdrawals larger than 50 USD, the fee is 25 USD. Since all trading accounts are maintained in US dollars (and not euros), a conversion fee is also charged on deposits and withdrawals. Therefore, your deposited amount will be converted into US dollars immediately. This is done at the current exchange rate.

If you want to use the eToro wallet, you will also have to pay a fee when you send your cryptocurrency from the platform to the mobile app. More details on the eToro mobile app / wallet can be found below.

In addition, eToro charges an inactivity fee of $10 if no login is made for a period of 12 months. However, this only happens if the account has funds. The fees are subject to change without notice. All current fees can be found at eToro on this website (click!).

**68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.

Sell cryptocurrencies on eToro

Customers on eToro can withdraw their funds (in USD!) at any time. It can be transferred to your verified bank account (the same account you used to deposit) up to the amount of the balance minus the amount of the used margin. You must have a verified bank account.

Processing a withdrawal order can take up to one business day. Depending on the payment service provider used, however, this period may be extended once again. Below are the guidelines provided by eToro until you receive your money

The minimum amount for a withdrawal is 50 USD. The fee is 5 USD. If you make a withdrawal in a currency other than USD, there will be additional conversion fees. These vary depending on the payment provider.

How does Social Trading & CopyTrading work on eToro?

CopyTrading on eToro

eToro’s social trading features clearly set the broker apart from the competition. The basic idea of social trading is quickly explained. Both the CopyTrader and CopyPortfolio functions are based on eToro’s user base of more than 6 million people from over 140 countries. Users can copy other users in order to make a profit – without having to deal with the subject in depth.

The copying user only needs to specify an amount he wants to invest. As a result all the copied trader does is automatically copied in real time. This way eToro’s system completely takes care of order creation. Please note:

- The minimum amount is 200 USD (per copied trader).

- The maximum amount is 500,000 USD (per copied trader).

- The minimum amount for opening a copied trade is USD 1.

Users can also intervene the system and manually adjust it to their own needs. If you do not want to follow a position, you can close it manually. However, it is important to note that trades that you close manually will cause the funds in that position to be credited to your copy amount – the amount allocated to copy that person, not the amount invested in open positions.

In addition, there are also the following aspects to consider:

- Existing open positions will be opened for you at market prices and not at the time of copying (the prices at which the original trades were opened do not apply).

- The trades have the same Stop Loss and Take Profit as the trader’s original trade.

Another important function is the Copy Stop Loss (CSL) function. This allows you to define a stop loss independently from the copied trader. This allows you to set a maximum value for possible losses. The CSL value can be set to a minimum of 5% and a maximum of 95%.

The default setting of eToro limits the CSL function to 40% of the total copy value you invest. In simple terms this means that if you bet 1,000 USD (and copy a trader with it) a stop loss will be activated when your capital, including profit/loss across all trades, is reduced to 400 USD (40% of 1,000 USD). When the CSL function is triggered, the entire trade will be closed and the minimum value (400 USD) will be credited to your eToro account. The following video gives a good overview of how to execute copy trading and set a copy stop loss.

How does CopyPortfolio work?

CopyPortfolio is a trading tecnique that is very similar to CopyTrading. The difference is that CopyPortfolios are thematic investment instruments. They are long term and are created by eToro’s experts and optimized by eToro’s automatic algorithms.

CopyPortfolios can either aggregate various assets into a single portfolio or focus on a specific market segment such as cryptocurrencies. On the other hand, there is also the Top Trader CopyPortfolio based on the CopyTrader function. This combines the most successful traders in different portfolios. The minimum amount for an investment in a CopyPortfolio is 5,000 US dollars. The stop loss for CopyPortfolios is set to 10% by default.

The eToro wallet

Since March 2019 eToro offers the possibility to manage Bitcoin and other Altcoins on a mobile wallet (an app). The app allows you to withdraw your “real” cryptocurrencies from the exchange and send them to your own wallet.

The eToro wallet is equipped with numerous features that make it interesting to download the app. For example, the eToro wallet allows the transfer of Bitcoin to other wallets, such as other crypto exchanges or hardware wallets. Furthermore the app offers the following features:

- exchange crypto-to-crypto

- payments in shops

- Make deposits

The app is available from the Apple Store and the Google Play Store.

It’s important to know that you have to meet certain requirements to be able to withdraw cryptocurrencies and send them to the eToro wallet. These restrictions relate to the time of your first deposit, your eToro Club membership level and the payment method you use. The following table shows the number of days that must elapse (in time) from the date of your first deposit compared to your Club membership level and the payment method you use before you can use the wallet:

And this is how it works: If you have installed the app, you can click on “Portfolio” and there on the “Edit Trade” setting gear to transfer the cryptocurrencies to the eToro wallet. On the tab “Funds“ you then have the option to click on “Transfer to the wallet“. Once you click on this link, the following popup window will appear showing you the number of units and the fee.

The transfer to the eToro wallet can take up to one business day for the transfer to be processed by eToro. After that further time may pass until the transaction is visible in the eToro wallet as the transaction still needs to be processed in the Bitcoin blockchain. During this processing the transaction appears as a “pending transfer” in the portfolio. It’s also important to know that a transfer fee is charged by eToro as well as a blockchain fee.

**68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.

Buy Altcoins on eToro

Besides Bitcoin, eToro currently offers 15 other cryptocurrencies.

- NEO (NEO)

- Tron (TRX)

- Tezos (XTZ)

- ZCash (ZEC)

- Binance Coin (NBB)

eToro review and our own experiences

Security and reliability

Especially with a broker like eToro, where you delegate the management of the private keys to a third party, they have to be well protected! With the private key the user delegates the control over his own assets to a third party, here: eToro! This makes it all the more important that the broker is serious and trustworthy.

This is clearly affirmative from our point of view with eToro. Customer funds are usually always well protected when the respective broker is supervised by a regulatory authority. eToro is controlled by two regulatory authorities at the same time, which are considered very accurate and strict in professional circles:

- CySEC: As eToro has part of its headquarters in Cyprus, the Cypriot CySEC is responsible for surveillance.

- FCA: Since eToro has also established a subsidiary in the UK, the UK FCA is also responsible for monitoring eToro.

Furthermore, the broker actively protects customer deposits by keeping them separate from company assets. Even if the Broker were to become insolvent, the customers’ funds would not be included in the insolvency estate. In addition, eToro offers deposit insurance up to a value of 20,000 dollar per customer.

Fees and payment options

Trading cryptocurrencies is a lucrative business, and the exchanges can set their own fees. Therefore it is worthwhile to compare. Like all exchanges, eToro requires a spread, as well as other fees for the transaction itself. It’s commendable that all fees can be found in the general information (FAQ) on eToro’s website. eToro is thus much more transparent than other exchanges and brokers. However, there is also a catch: Especially for long-term investors and investors, the fees can quickly add up.

The fees are above average in comparison. However, eToro also provides a very secure and professional platform for this, offering numerous features and advantages. The deposit options are the same as for credit cards, Giropay, Neteller, PayPal, Skrill Limited UK, WebMoney and SEPA wire transfer.

The support

From our experience the broker offers a very good and fast support. This is available via a live chat and a customer support ticket system 24 hours a day, Monday to Friday. We have had very good experiences with the live chat in particular and have always received help within a few minutes.

Hacks

We are not aware of any hacker attacks where cryptocurrencies were stolen from eToro.

Bottom line

eToro is in our opinion not without reason one of the largest and most popular brokers in Europe. If you want to buy Bitcoin on eToro you have the choice to buy BTC as a “real” cryptocurrency or as a CFD. For both ways eToro is a good option.

**68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorised and regulated by the Cyprus Securities and Exchange Commission.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework.

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.