Brief information

>> Buy and sell crypto CFDs on Plus500* <<

Risk Warning: 80.6% of retail CFD accounts lose money.

This is Plus 500 – Short Introduction

The Plus500 trading platform is operated by Plus500UK Ltd. This is a London-based company registered in the UK that was founded in 2008 and went public in 2013 to sell shares for the first time.

Plus500UK is in turn a subsidiary of Plus500 Ltd, a company listed on the main market of the London Stock Exchange for listed companies and headquartered in Haifa. As Plus500UK Ltd is domiciled in the United Kingdom, the trading platform is authorized & regulated by the British Financial Supervisory Authority (FCA) (#509909) for its Contracts For Difference (CFD) offer. This ensures that client funds are secured in accordance with the legal requirements of the FCA. Once the personal information has been transferred, each user will be covered by a deposit insurance up to £85,000 (GBP).

The Plus500 platform is one of the best-known and largest CFD brokers in the world. It offers a portfolio of over 2,000 financial instruments such as CFDs on equities, commodities, forex, indices and cryptocurrencies. In contrast to exchanges and other brokers, however, no “real” cryptocurrencies can be purchased (or sold), just crypto CFDs.

Plus500 also offers a browser-based webtrader and an Android and iPhone app for trading on the go. Both the website and the other applications are very clearly and simply structured, so that the operation is also very intuitive and easy for beginners.

What cryptocurrency CFDs does Plus500 offer?

The platform offers a total of 12 cryptocurrency CFDs. CFDs are so-called derivatives – a security whose value or performance depends on the performance of one or more underlying assets. They are specialized and popular over-the-counter (OTC) financial products that allow traders to easily open positions in a variety of different financial markets. The underlying asset – the cryptocurrency – is not actually acquired by the investor, but merely a certificate on it.

This has the advantage that the purchase and sale of Bitcoin, Ethereum and other Altcoins is much less complicated. However, you also don’t have the possibility to benefit from all the advantages of cryptocurrencies, for example paying with BTC in real life.

Compared to other brokers, Plus500 thus has a comparatively small selection:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

- Cardano (ADA)

- IOTA (MIOTA)

- Monero (XMR)

- NEO

- EOS

- Stellar (XLM)

- Tron (TRX)

The Plus500 demo account

For beginners Plus500 offers a free demo account. You can use this for an unlimited time to gain your first experience in trading cryptocurrencies. From our point of view, the use of the demo account for newcomers is a good way to get to know the user interface and gain some experience in trading with cryptocurrency, since Bitcoin & Co. can be very volatile.

You should keep in mind that trading with cryptocurrencies can allow very high profits in a short time. However, with cryptocurrencies you can also very quickly suffer very high losses, especially when using levers. Plus500 charges the demo account with €40,000 in play money, giving you enough capital to gain extensive experience. If your demo capital is completely lost, it will be reloaded.

To switch to the demo mode, there is the item “Switch to demo mode” at the bottom of the menu.

>> Buy and sell crypto CFDs on Plus500* <<

Risk Warning: 80.6% of retail CFD accounts lose money.

Plus 500 costs and fees

Like any other broker, Plus500 also charges a fee that users should be aware of in advance. Plus500’s conditions are above average, which is also reflected in the broker’s high level of customer satisfaction. Plus500 does not charge any fees for trading. For active traders in particular, this can be a significant advantage over other brokers, as the profit zone in this area is often a very thin line.

Below is a list of all the fees Plus500 charges:

- Overnight fees are referred to by Plus500 as “overnight funding amount” and are automatically debited (or added) to your account when you leave a position open after a specified time (the “overnight funding time”). The formula used to calculate the daily overnight financing amount of a position is:

Trading volume * Opening price * Daily overnight financing %.The overnight financing period and the daily overnight financing percentage can be found depending on the investment under the link “Details” next to the name of the instrument. - Market spreads are used by Plus500 to realize a large part of the financing of the trading platform. The spread is the difference between the offer price set by Plus500 and the selling price. For example, if the underlying is traded at 7.975, the offer price may be 8.000 and the selling price 7.950. If you want to know the spread value, you can also deduct the selling price from the price.

- Inactivity fee: Like eToro, Plus500 charges a fee if the user does not actively use their account for a period of three months. This fee can be up to 10 USD. The fee will also only be charged if sufficient funds are available in the account. In addition, a simple login is enough to be “active” in the sense of Plus500.

- An increased spread (“wider spread”) is required for guaranteed stop orders. The increased spread in turn depends on the financial instrument.

As a rule, there are no fees for deposits and withdrawals. These may only be incurred by third parties, e.g. with international credit cards and currency conversions.

How do I set up a Plus 500 account?

The first step in registering with Plus500 is to visit the official plus500.com website (click here!)*. In the upper right corner you will find the button “Start trading”. When you click on this button, you will need to click the “No Account? Create one now”. Enter the email address by which you’re registered here, and a password for your account. Then you can create an account.

You will then be automatically logged in and taken to the user interface. That’s how fast you can create your Plus500 account.

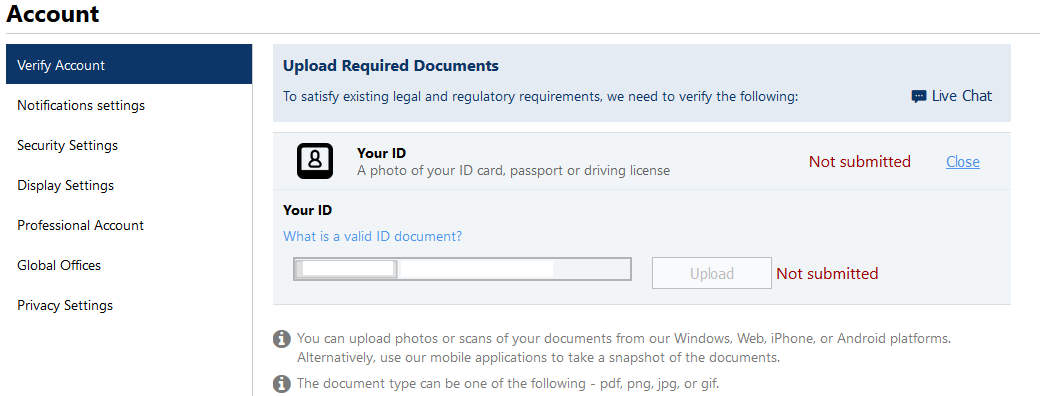

Verification on Plus500

Before you can start buying (or selling) cryptocurrency CFDs, you need to verify your identity. You can do this by clicking on “funds” and “confirm account” in the left side menu. You will now be taken to a page where you will need to enter and confirm some personal information. Fill in the required fields, such as surname, first name and date of birth.

Following this query, there are many more questions about your country of residence, your nationality, your home address and the country in which you pay taxes. Below you have to answer some questions about your investment experience. Don’t be afraid to be honest, even if you can’t answer all these questions correctly or have no experience, you can still buy (or sell) cryptocurrency CFDs.

Once you have successfully answered the questions, you will be taken to the next step to set up your account. You need to upload the following documents to Plus500 and verify the following information:

- Front and back of your passport

- proof of address (e.g. a telephone or electricity bill)

- Verify phone number

- Verify email address

>> Buy and sell crypto CFDs on Plus500* <<

Risk Warning: 80.6% of retail CFD accounts lose money.

Deposit options and limits on Plus500

To deposit money into your account, after successful verification, simply click “Funds” again and then “General”. Here you have the possibility to make a deposit. Both steps are marked red in the screenshot.

You will then be taken to a new page where you can select different payment methods. The following deposit options are available to you:

- Deposit by credit card or debit card

- PayPal

- bank transfer

- GiroPay

- SOFORT

The following table shows the respective deposit methods, as well as the minimum and maximum deposit amount.

Once you have selected your deposit method and deposited the money, you can proceed to buy or sell crypto CFDs.

How can I buy and sell cryptocurrencies on Plus 500?

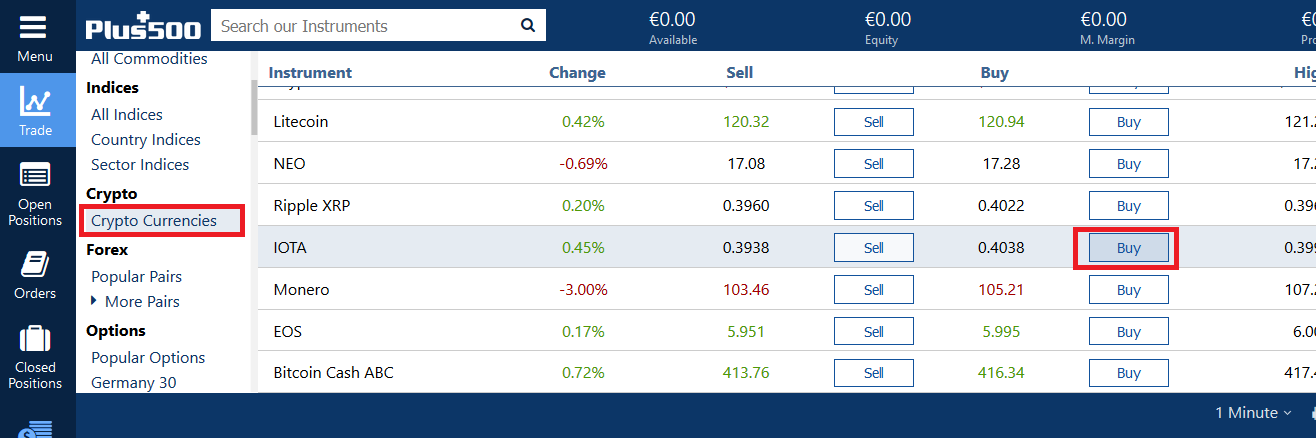

To buy (or sell) cryptocurrency CFDs, click in the left bar on “Cryptocurrencies” and then on the desired cryptocurrency, as shown in the screenshot example with IOTA “buy” (or “sell) (framed in red in the screenshot).

Disclaimer: The prices in the image are for illustration purposes only

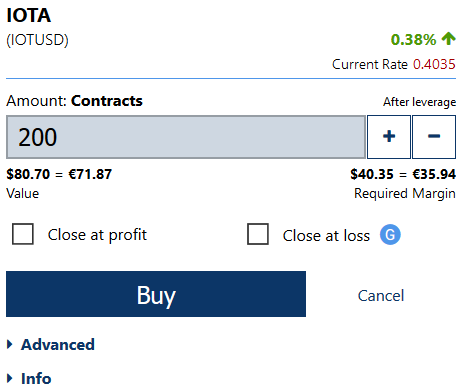

Now you must enter in the free field how many contracts you want to buy (or sell). The screenshot shows an example of IOTA:

Disclaimer: The prices in the image are for illustration purposes only

On Plus500 you can trade cryptocurrency CFDs with a maximum leverage of up to 1:2. This means, for example, that you can start with only €100 to invest with an effect of €200. If you click on “Buy” (or “Sell”) now, you will immediately receive your selected number credited to your account.

>> Buy and sell crypto CFDs on Plus500* <<

Risk Warning: 80.6% of retail CFD accounts lose money.

How can I sell cryptocurrencies on Plus 500?

The Broker waives the right to charge fees for payments. Like other brokers, Plus500 has set a minimum payout for this. As soon as you have sold your cryptocurrency CFDs, you have the possibility to make free withdrawals for a certain amount or more. If you want to make a withdrawal, you only need to have this amount in your Plus500 account.

For SEPA credit transfers and credit card use, the minimum amount is 100 euros. With PayPal and Skrill, the amount is even lower, at 50 euros. Lower amounts can also be paid out. However, in this case there is a fee of 10 Euro per payment.

Plus 500 put to the test

Security and seriousness

Especially in the financial sector it is essential to use a reliable broker. This can definitely be affirmed with Plus500. For example, the broker protects his client assets up to an amount of 85,000 pounds sterling (GBP). In addition, client funds are held in separate bank accounts and are therefore not mixed with corporate capital, which can be very important in the event of insolvency.

Plus500 also protects its customers by waiving the obligation to make additional contributions (as is the case with eToro), so that negative account balances are not possible despite trading with levers. This means that traders can only lose the maximum amount of money they have deposited.

Fees and payment methods

Trading cryptocurrencies is a lucrative business for companies, as they can set their own fees and prices. As an investor, you should therefore first compare the prices of other brokers. Basically, it can be said about Plus500 that the fees and spreads are comparatively low. However, it should be noted that the platform is more suitable for short-term investments.

Due to the fact that no trading fees are charged, the trading platform is very popular with day traders. A long holding of cryptocurrencies is however less meaningful due to the overnight fees. Long-term investors should carefully consider how the cost of overnight financing will match the risk and potential returns. In this case, you should consider whether it is worth paying the fees. Alternatively, another cryptocurrency exchange can be more lucrative and profitable for you.

The Support

Plus500 offers multilingual customer support in 16 languages (English, French, German, Spanish, Portuguese) to help in an emergency. However, the contact possibilities are comparatively small. There is mail support and live chat. In our experience, live chat is a very fast way to get an answer, often within minutes. Thus, we can classify the Plus Support as good to very.

hacker attacks

We are not aware of any hacker attacks.

Conclusion – Is Plus500 a scam?

Plus500 is a worldwide operating and very popular broker for all financial instruments. Due to the licensing by FCA and the protection of customer funds, Plus500 can be classified as a very reputable broker.

It’s also praiseworthy that Plus500 offers a demo account, has low fees and clearly shows these. Furthermore, the company expressly points out that the risks involved in trading CFDs are very high. According to the broker’s own statements, 80.6% of new users lose money.

>> Buy and sell crypto CFDs on Plus500* <<

Risk Warning: 80.6% of retail CFD accounts lose money.

Plus 500 alternatives

eToro is also a well known cryptocurrency CFD broker offering both the buying and selling of “real” cryptocurrencies by credit card and the trading of 14 cryptocurrency CFDs. You can use up to a double lever to bet on the exchange rate of the cryptocurrencies. >> Read our Review of eToro <<

Litebit is our top recommendation for you. The exchange offers 50 different cryptocurrencies for direct purchase by credit card, SEPA, SOFORT and much more. The customer support is really fantastic and always reachable. We have been a regular customer of the exchange for 4 years and are very satisfied. >> Read our Litebit review <<

Coinmerce offers over 100 different cryptocurrencies for purchase by credit card. Customer support is really good and always available. We have been a regular customer of the exchange for 2 years. >> Coinmerce Review and Rating <<

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.

Binance is one of the largest exchanges worldwide and is considered to be particularly user-friendly and secure. Within just a few months, Binance has risen to become the largest exchange in terms of trading volume. It is also possible on Binance to buy Bitcoin, Ether and XRP directly by credit card. >> Binance Review and Test <<

[ratings]