- Bitcoin is showing strength on the technical chart setup and any breakout above $23,300 could push it further to $25,000.

- The Bitcoin futures market shows that long positions are once again building up after huge short liquidations last month.

The world’s largest cryptocurrency Bitcoin (BTC) has had a great start to the year 2023 after a brutal market crash last year. Over the last month, the BTC price gained 39.4% making it the best January after 2013 as well as the best-performing month after October 2021.

As of press time, Bitcoin (BTC) is changing hands at $22,996 and has a market cap of $443 billion. Any future price action will strongly depend on the macro developments and the Fed rate hike later today. As per market expectations, the US Federal Reserve will increase the interest rate by 25 basis points pushing up the interest rate from 4.5% to 4.75%.

On Tuesday, Bitcoin witnessed a bit of selling pressure, however, the BTC bulls were able to hold the price above the crucial support of $22,510. On the upside, the crucial levels on the Bitcoin technical charts are $23,300. Any breakout above this could set BTC for the next leg of the runup.

Crucial level remains $23,300 for #Bitcoin at this point. pic.twitter.com/x2ztZM8FDv

— Michaël van de Poppe (@CryptoMichNL) January 31, 2023

If the BTC price moves above this crucial resistance of $23,300, its immediate next target could be $25,000. Seasoned trader and market expert Peter Brandt further added an interesting technical pattern and a “double-walled fulcrum pattern” and a breakthrough from it. Brandt added that the BTC price could rise to $25,000 in the near future.

The bottom in $BTC is a double walled fulcrum pattern. Extremely rare. The 2X target is mid 25's. pic.twitter.com/NfffzbniO5

— Peter Brandt (@PeterLBrandt) January 29, 2023

Another popular crypto trader Rekt Capital noted that the Bitcoin price will continue to hover in the price range between $20,000 and $23,400. However, Bitcoin has not managed to cross above the bullish monthly candle close above $23,400.

#BTC really fighting to secure a bullish Monthly Candle Close above ~$23400

Only one hour left to go

Currently price is at $23150$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) January 31, 2023

Bitcoin’s On-Chain Data

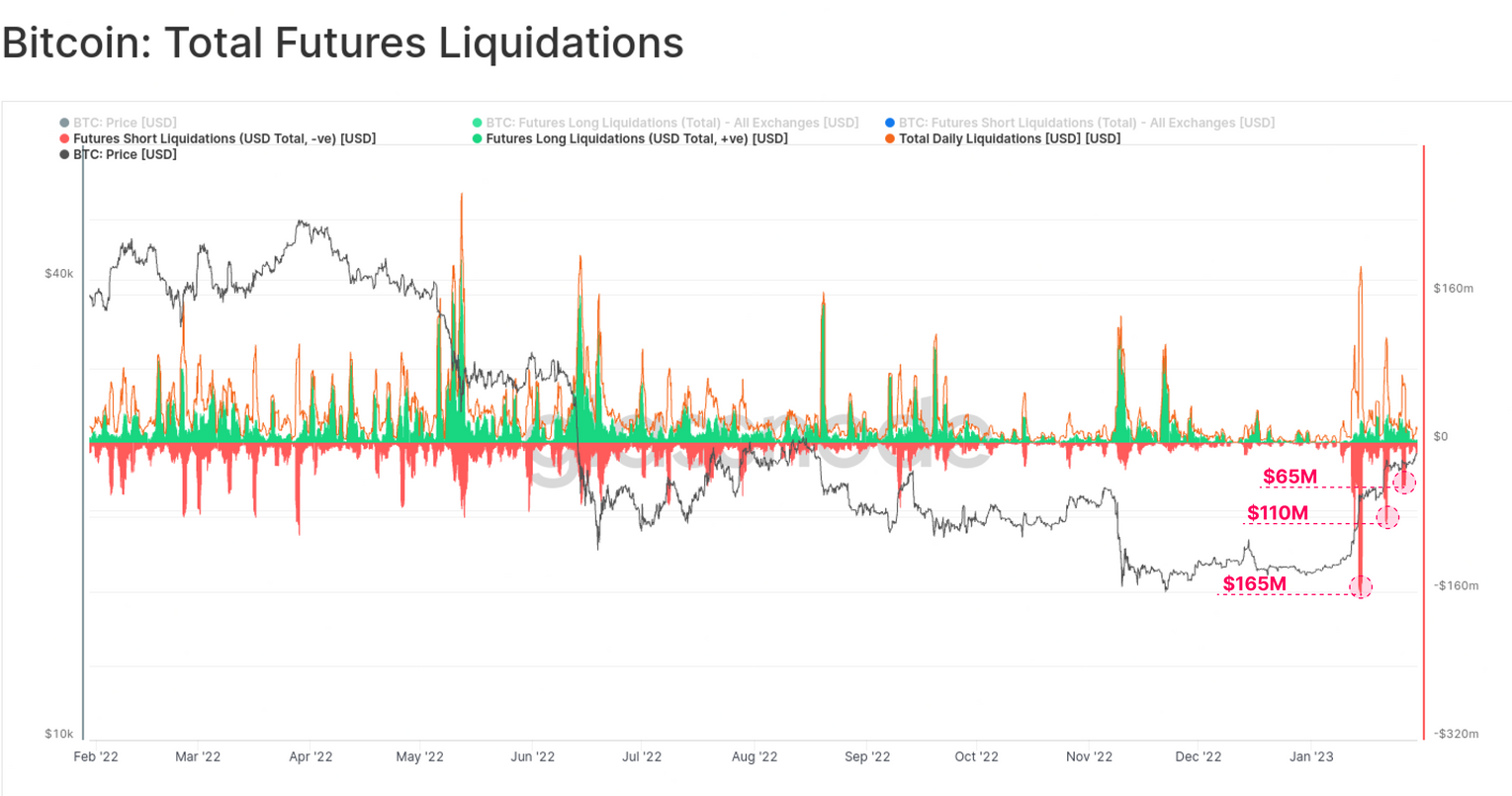

The on-chain data and futures market has shown some positive signs as the BTC price has started to recover. As per on-chain data provided by Glassnode, the short position liquidations cleared out the unhealthy market speculators. Glassnode analysts stated that a large group of investors who were previously at a loss are now at “unrealized profits”.

The short liquidation dominance during the last month of January helped fuel the BTC price rally. During the last month of January 2023, nearly $500 million of short futures liquidations took place.

Courtesy: Glassnode

But after a historic month of short liquidations, the futures market is once again building towards long. Earlier this week on January 30, 51.46% of open interests were long positions instead of shorts. The Glassnode researchers wrote:

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.

Across both perpetual swap, and calendar futures, the cash and carry basis is now back into positive territory, yielding 7.3% and 3.3% annualized, respectively. This comes after much of November and December saw backwardation across all futures markets, and suggests a return of positive sentiment, and perhaps with a side of speculation.

Courtesy: Glassnode

Furthermore, the Glassnode data shows that a large cohort of Bitcoin investors have returned to the zone of “unrealized profits” as the Bitcoin price is trading above $21,000.