- During the first 24 hours of Bakkt’s launch, only 73 Bitcoin (BTC), worth almost USD 700,000, were traded.

- Kelly Loeffler, CEO of the Intercontinental Exchange and Bakkt, said it may take weeks or even months for investors to get on board and see the true potential in effect.

Yesterday the Bitcoin Futures on the Bitcoin exchange Bakkt started with great anticipation. Early hour investors wanted to be there from the start and not miss a potential rise in Bitcoin’s price (=Fear of missing out, “FOMO”). Unfortunately, Bitcoin investors were rather disappointed when they looked at the trading volume of the first 24 hours.

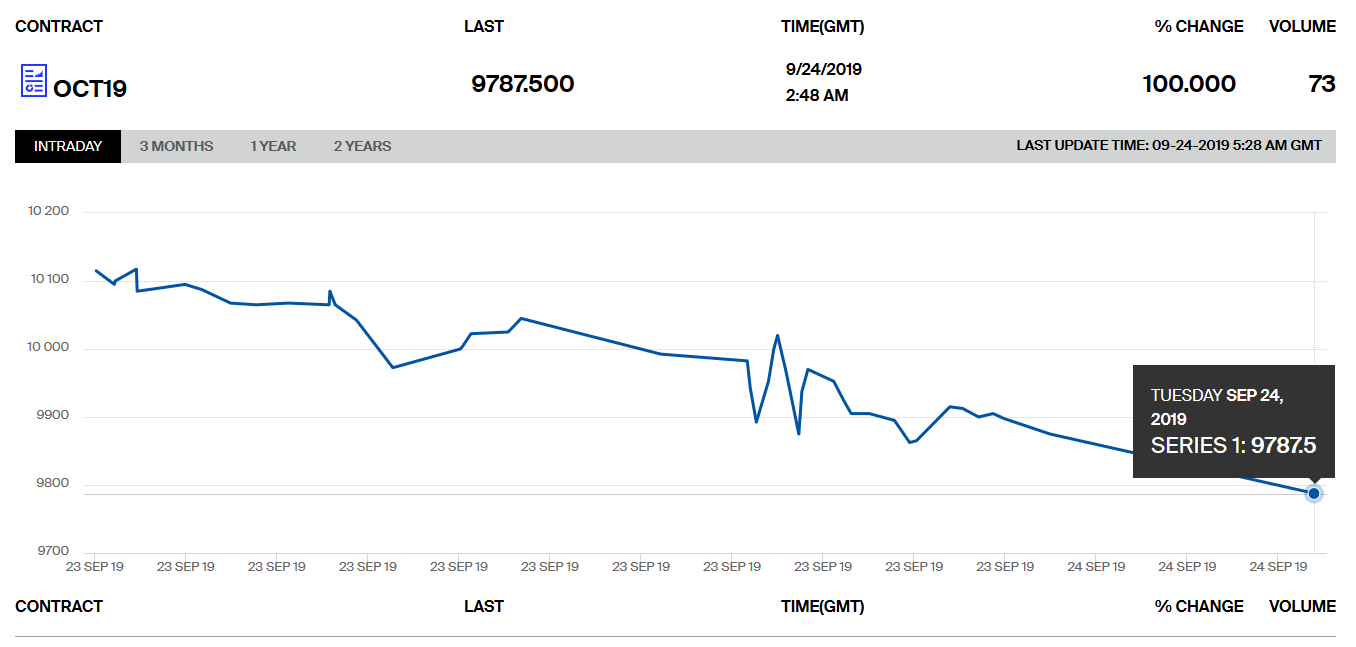

At the time of writing, only 73 Bitcoin (BTC) worth just over USD 700,000 were traded. Meanwhile, Bitcoin’s price has dropped further to USD 9,787.50, showing a downward trend of -2.23% over the last 24 hours.

Source: https://www.theice.com/products/72035464/Bakkt-Bitcoin-USD-Monthly-Futures-Contract/data?marketId=6137541

However, the “bad start”, as some call it, is not discouraging. Most traders are not ready yet and will observe the developments of the first days.

Poor start to BTC futures: Will a falling Bitcoin price follow?

Even though demand and trading volume on the crypto market have been rising again since the beginning of the year, we are not in a comparable hype as we were at the end of 2017. The launch of the Bitcoin futures on the CME caused a bull run and a rising Bitcoin price to more than USD 20,000 in the meantime.

CEO of Three Arrows Capital, Su Zhu, expected a weak start and says that many investors are not yet ready for trading. In his opinion, a few days and weeks will go by before the trade picks up speed:

Bakkt will probably first be a dribble and then a flood. The reality is that most regulated futures contracts on day 1 are simply not all futures brokers willing to clear it, many investors want to wait and see, the tickers are not even populated on risk systems, etc., so it’s not easy to get a clear picture.

The CEO of Bakkt, Kelly Loeffler, describes in an interview that many asset managers have told her in confidence that the volatility of Bitcoin for transactions in the consumer market is negative. However, institutional investors with large amounts of capital can benefit even more. According to Loeffler, Bitcoin’s price performance does not correlate in any way with trends in equities, bonds, gold or real estate.

This opens up new opportunities for many investors looking for a new profitable alternative to the traditional financial market. Furthermore, Bitcoin’s total returns are “unsurpassed” compared to the equity and forex markets. The first investors are therefore likely to be university and pension fund foundations:

The brokers are always looking for an edge to attract new customers, and offering Bitcoin could have lots of appeal,” she says. As for money managers, Loeffler thinks the most likely takers are college endowments and pension funds: “They’re the ones who are usually in the forefront in adopting new investment ideas.

Bitcoin Futures, Bitcoin ETF – what is next?

Another positive “driver” of the Bitcoin price is said to be an approved Bitcoin ETF. To date, the SEC has rejected all applications on the grounds that the Bitcoin market is not mature enough and there is still “a lot of work to do” until a Bitcoin ETF application is approved.

Much more crucial than new financial products which could drive up the price of Bitcoin, however, is the adaptation and actual use of the blockchain in practice. As we reported, according to VeChain CEO Sunny Lu, the most important thing is to work with large companies as they can ensure a widespread mass adoption:

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.

Only with professional teams and enterprise-level applications can we drive the development of blockchain technology and increase its mass adoption.

Acceptance and trust in Bitcoin is increasing steadily. However, after more than 10 years, the crypto market is still in its early days. It therefore remains to be seen which development Bitcoin and cryptocurrencies will achieve.